Defining and Positioning Super KVIs: Smart Approach to Assortment Segmentation

Overhaul the products segmentation to mark out actual anchors in your portfolio

Challenge

Ward off profit loss due to the wrongly identified KVIs

Retailers risk to lower metrics because of inaccurate positioning caused by the following factors:

- Outdated approaches to defining product roles

- Shortage of tools for rapid and efficient data processing

- Lack of regular updates about changes in purchasing behavior

- Product positioning powered by competitors' pricing decisions only

- Changes in KVI lists after the new items enter the market

- Difficulties in adapting the list of KVIs to different seasons

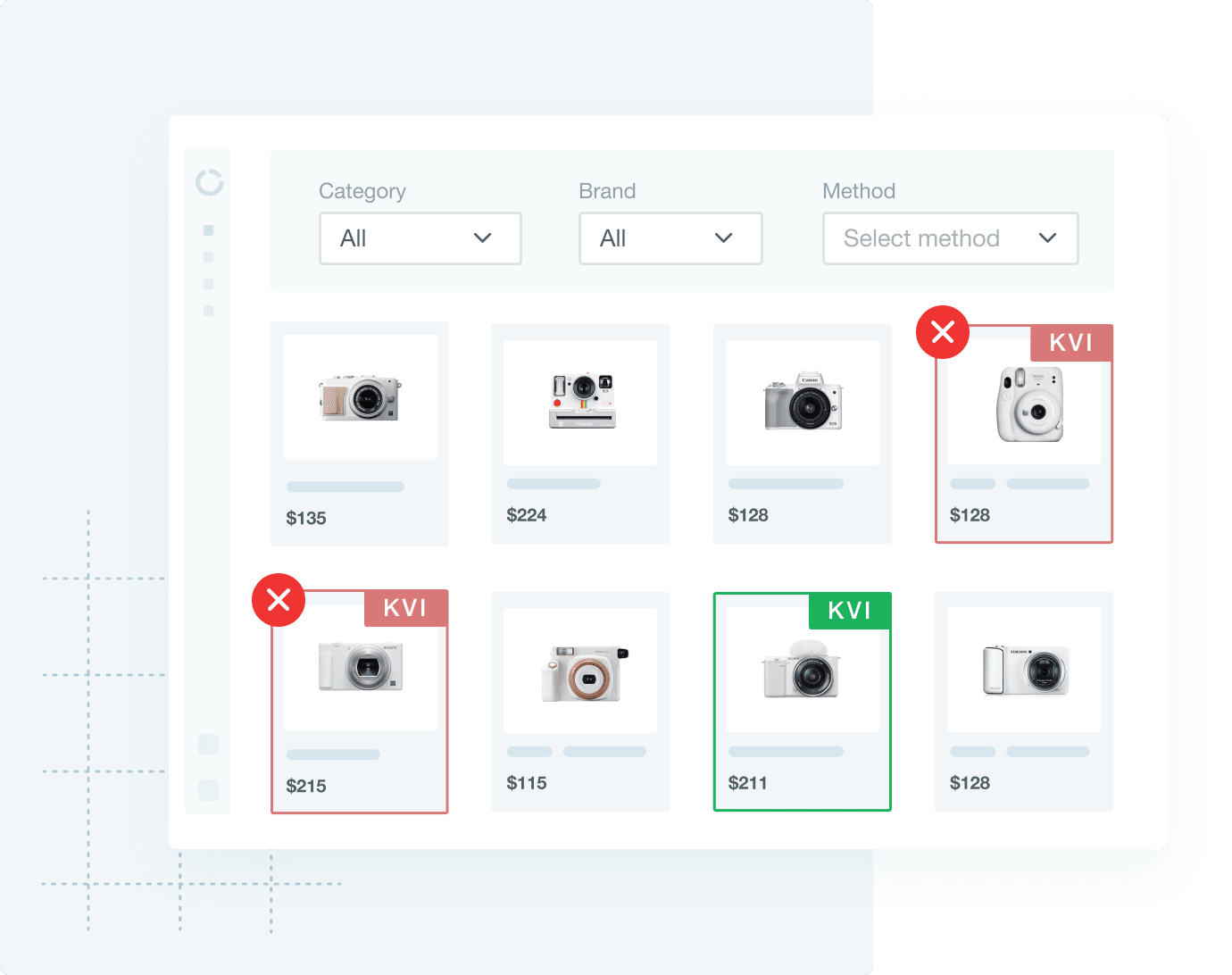

Only 10 to 20% of the products are true KVIs. However, retailers mistakenly name KVIs 30-50% of the products.

Solution

The right price for every item in portfolio allows balancing sales volume and profit

-

Decisions driven by data, not intuition

Retailers obtain a comprehensive picture of every product's performance in their portfolio. Based on this information, pricing specialists can work out and implement an effective pricing strategy.

-

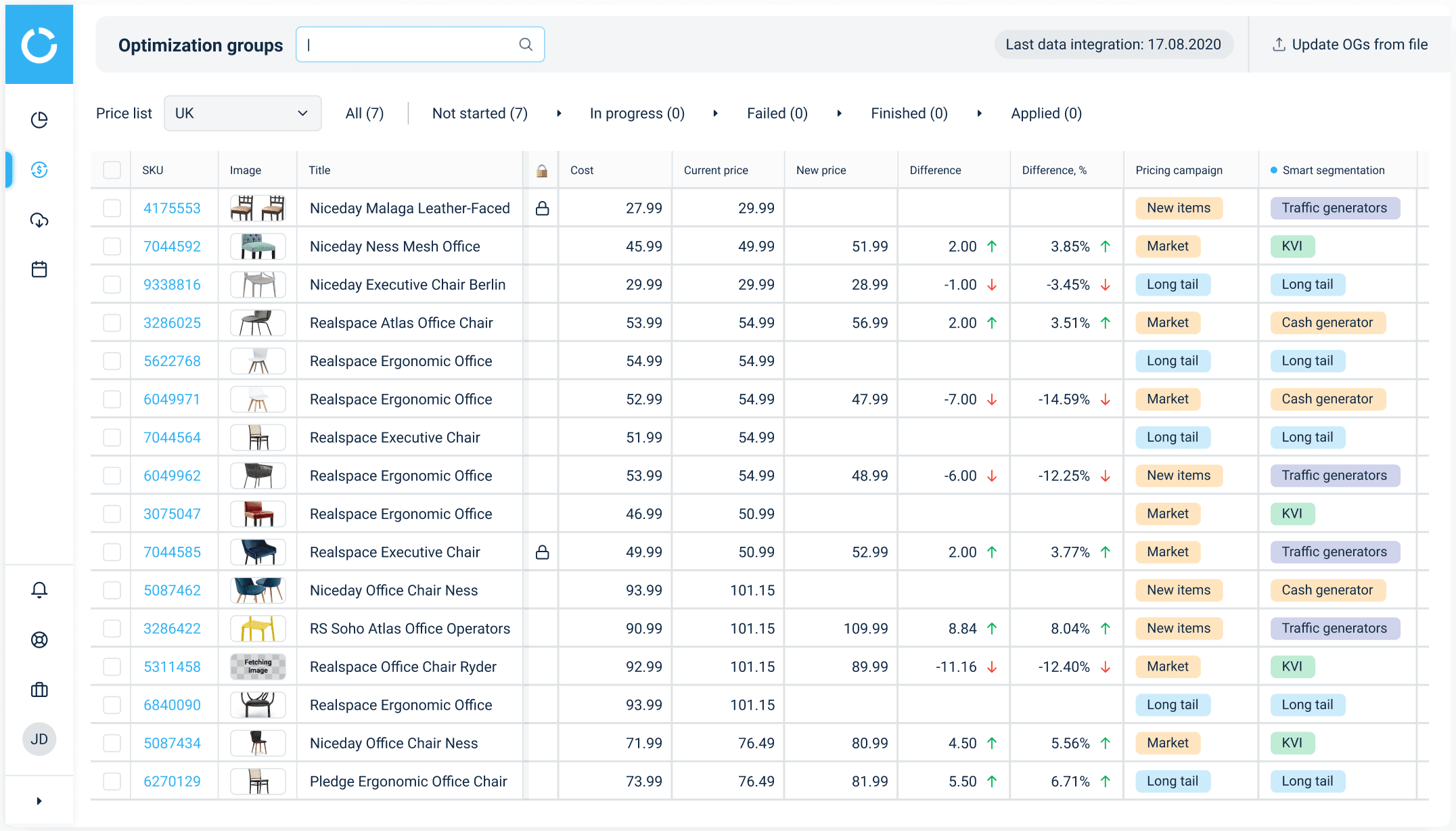

Swift, timely, and precise repricing

No manual data processing. Algorithms analyze a great wealth of inputs and deliver results in the shortest time. Retailers monitor changes in the KVIs list on a regular basis and respond proactively by updating prices.

-

More freedom in pricing super KVIs

There's no need to set the lowest price to outcompete rivals. Instead, retailers can craft optimal prices based on multiple factors (e.g. promo elasticity, basket analysis, competitive data) to yield profit.

Use case in practice

Three steps to define and set the price for super KVIs

Get inputs

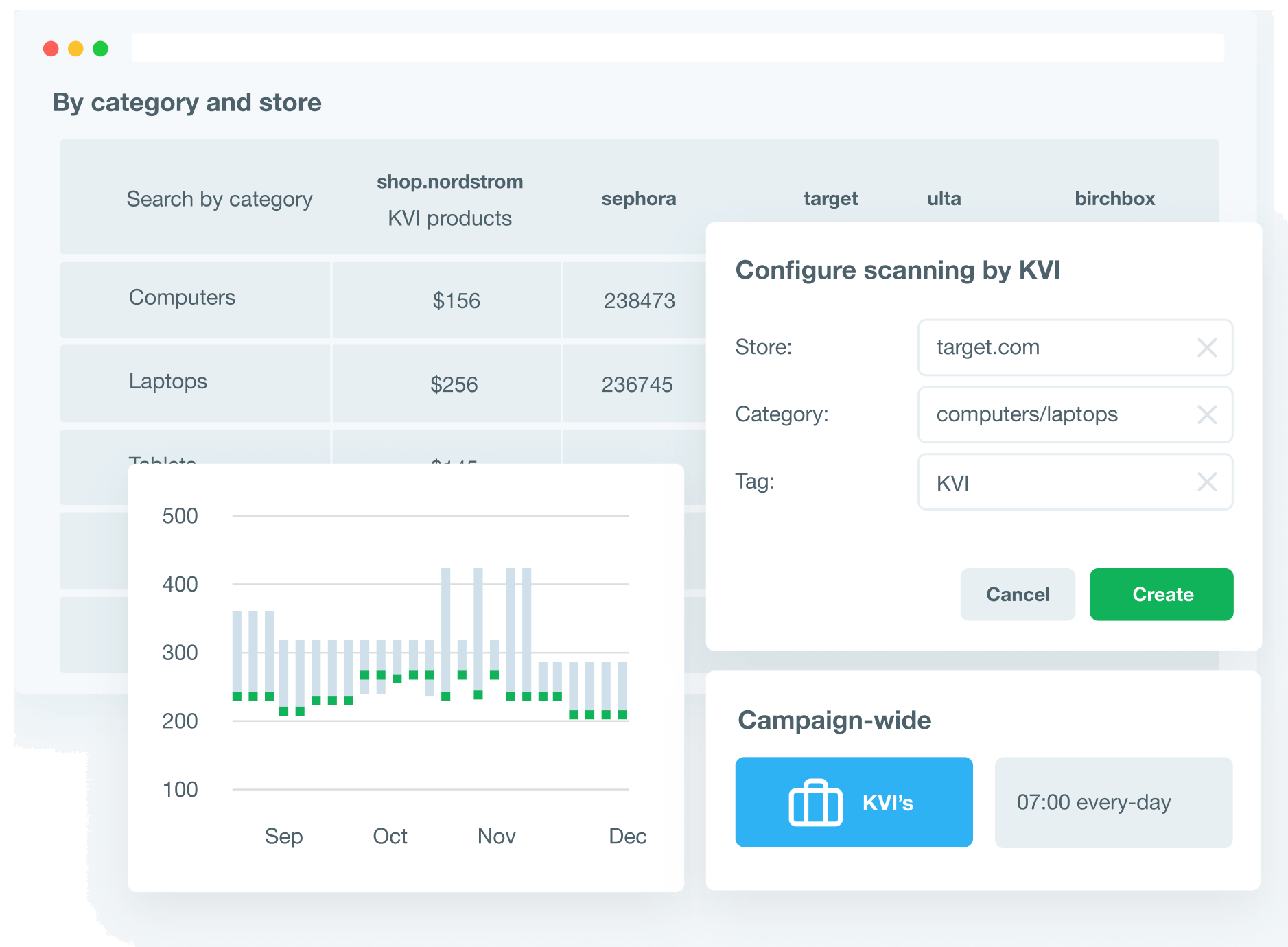

The more data retailers have, the more precise product segmentation is. Typically, the data set needed for ML-driven segmentation includes:

-

consumer research data

-

ABC analysis results

-

sales data

-

competitor elasticity check

-

web traffic analysis

-

promotions (TPRs, Buy X Get Y, and other types) elasticity evaluation

Analyze inputs

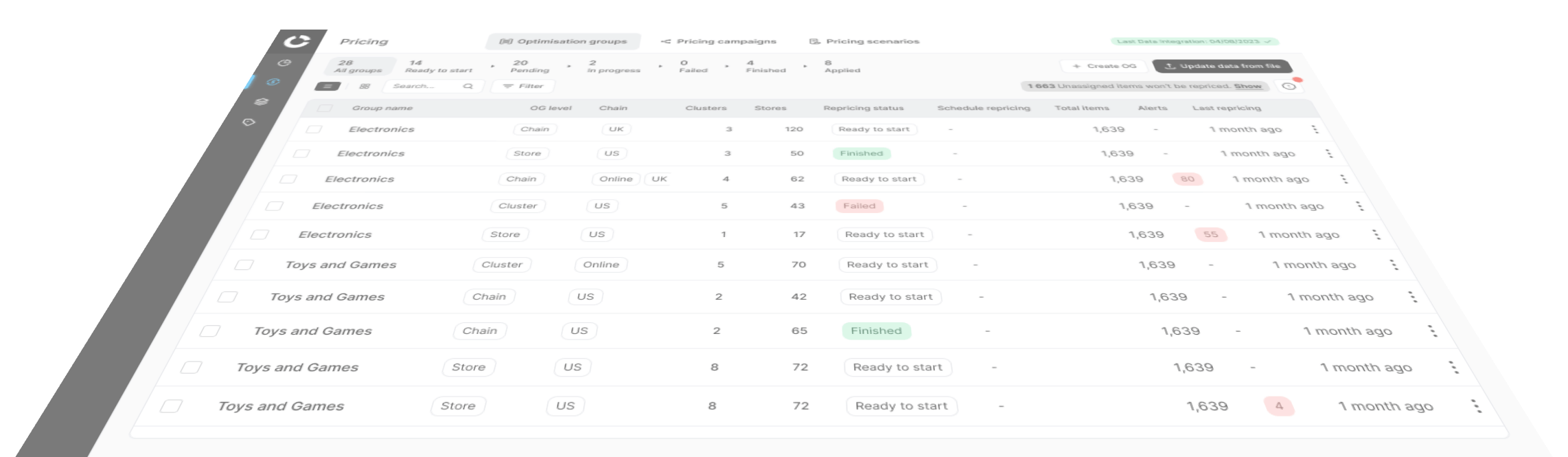

Algorithms allow for processing large volumes of information quickly. The analysis results are then considered while crafting price recommendations. Competera's platform enables retailers to automate product segmentation and make it regular (e.g. every 3, 6, or 12 months). Dynamic reconsideration is crucial as external factors change the behavior patterns of consumers and therefore the demand.

Use outputs for pricing decisions

Algorithms define product roles in a portfolio. The system works with different variables, processes them, and enables retailers to take the outputs into account while deciding on the best performing strategy for this role and its contribution to the overall portfolio goal.