Recover up to 6% of margin

Stop losing margin by shifting to portfolio-based AI pricing based on own price elasticities and cross-dependencies between products

Traditional pricing approaches lead to recurring margin losses

Portfolio-based AI pricing is the cure

- recovery of up to 6% of previously lost margin

- increased customer lifetime value

- up to 60% promo pressure reduction

- increased average selling price / basket value

- an average of 8% revenue rebound

How portfolio-based AI pricing works?

Competera's portfolio pricing relies on a

demand-based pricing engine powered with neural networks measuring products own price elasticity and cross-elasticities to ensure that goals on both the product and the category level are achieved.

The algorithms can work on separate assortment groups, which allows parallelization and scalability. The accuracy of every recommendation is achieved through context-dependent price elasticities and a high-performance solver capable of shoveling through billions of possible price combinations to find the right one.

Data input

- Transactions (min 2 years)

- Promo calendars (min 2 years)

- Price lists

- Inventory

- Product reference tables

Approach

- Measuring the response of demand to price changes

- Processing historical data to evaluate the impact of pricing and non-pricing factors

- Selecting optimal prices for the whole category

- Aligning goals on category and portfolio levels

No more black boxes: every recommendation is explained

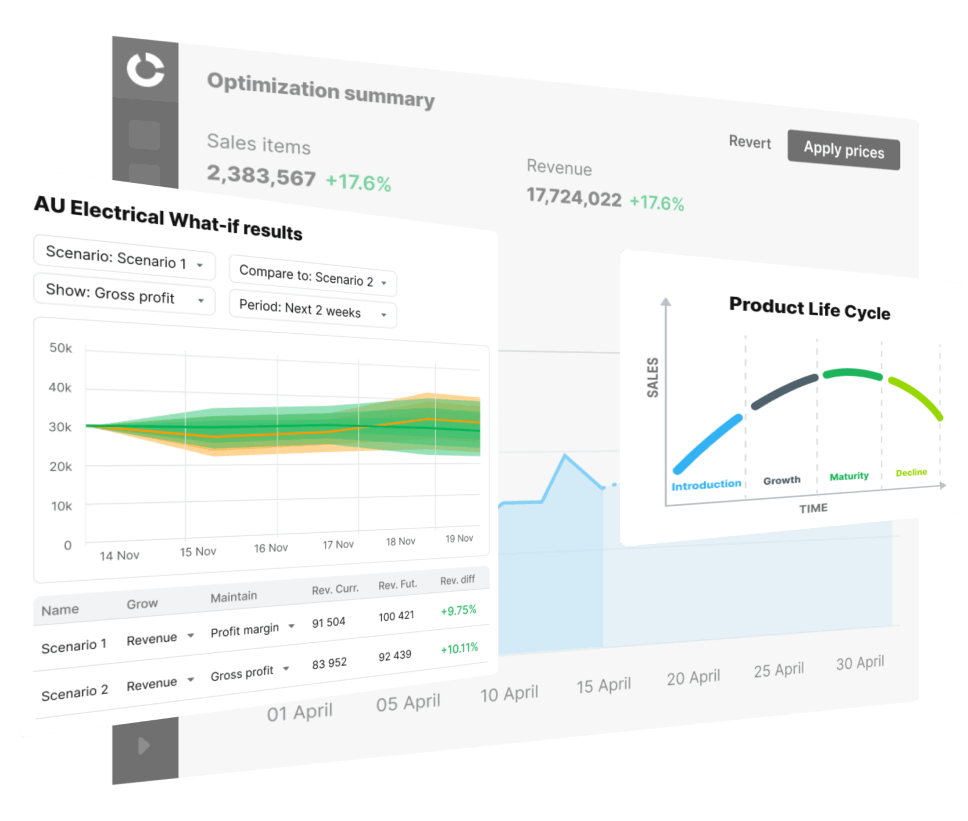

Figure out the reasoning behind the optimal price recommendations.Competera interpretability features allow to:

- get insights on what was behind the Price Optimization engine’s decisions;

- check out how the set limitations have impacted the search range;

- find out what the demand elasticity curves look like;

- understand how the new price point impacts own product sales and what halo effect it has on other products in the category.

See advanced AI pricing software in action