There’s a simple workflow for consumer price index formula you can follow to single out your real competitors, calculate their impact on your sales, adjust your pricing strategy, and avoid price wars. To find out who exactly influences your sales, you first need to calculate the Price Index.

What is CPI?

The Consumer Price Index (CPI) is a key metric used to measure changes in the average price of a basket of goods and services over time. Retailers often rely on CPI matrix to analyze inflation trends, compare market dynamics, and adjust pricing strategies.

But how is CPI calculated, and who calculates CPI? National statistical agencies, like the U.S. Bureau of Labor Statistics, compile this data based on consumer spending patterns. The CPI calculation formula divides the cost of the current basket of goods by the cost of the same basket in a base period, then multiplying the result by 100.

For instance, using a CPI calculator formula example, if the current basket costs $120 and the base-period basket is $100, the CPI would be 120. Retailers use such CPI examples to gauge pricing efficiency. Understanding how to calculate CPI equation helps businesses adapt to economic shifts effectively.

How To Calc CPI To Define Your Real Retail Competitors

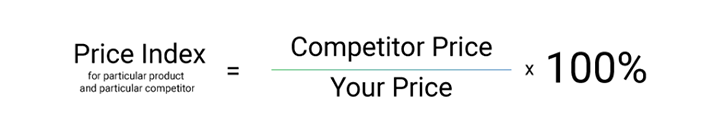

The Price Index is a normalized average of price relatives for a particular category of products or services in a specific geographical region for a given time period. There are dozens of complex formulas used to explain the idea of PI, but we are here to share with you a much simpler equation for CPI you can apply directly to your business with minimal effort.

Consumer price index example:

The simplest example of Price Index usage is for the end of the week, month, quarter, or year when the retailer wants to discover the reasons why their net profit decreased. As long as the Price Index is directly connected to sales, it’s easy to see using historical sales and pricing data.

Below you’ll find a theoretical and practical macroeconomics part on how to calculate formula for CPI model to define your real competitors and their impact on your sales.

Price Index Calculation: Average CPI Formula

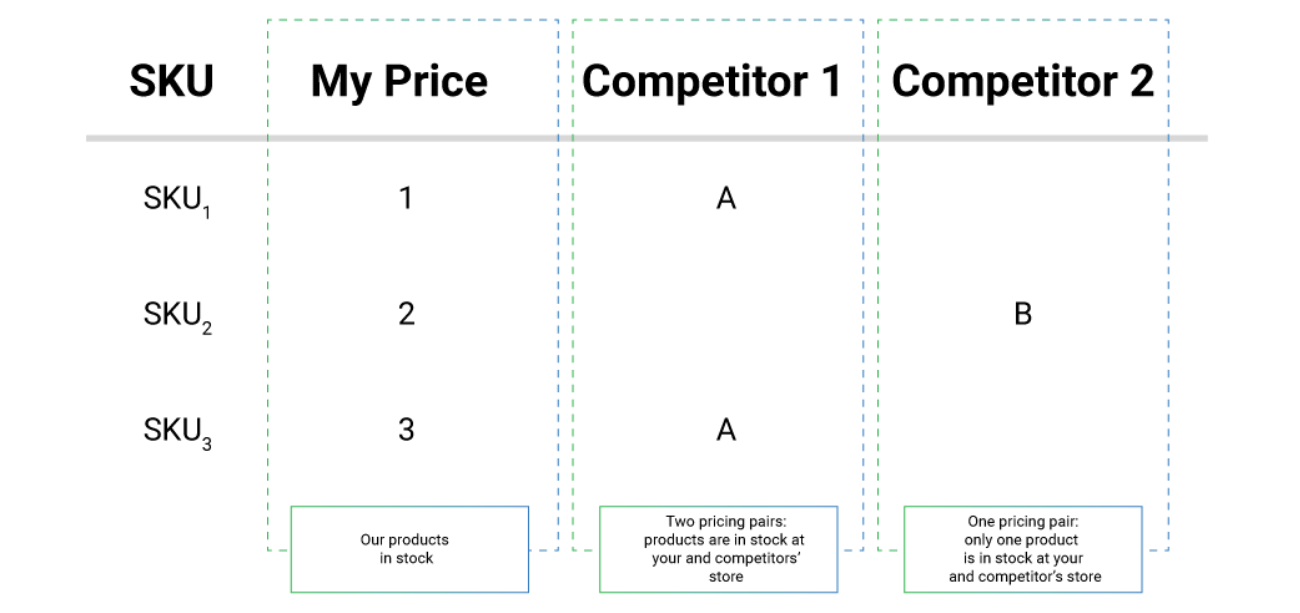

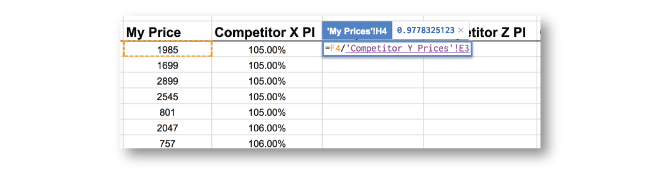

So, how do you calculate CPI? To calculate the price index, firstly, you need to collect all the price overlap pairs (the intersections of products that you and your competitors have).

Once you have this information, you need average index formula for each product and for each competitor. To do this, you need to divide the cost of a competitor's product by the cost of a similar position from your range.

Once you have this information, you need average index formula for each product and for each competitor. To do this, you need to divide the cost of a competitor's product by the cost of a similar position from your range.

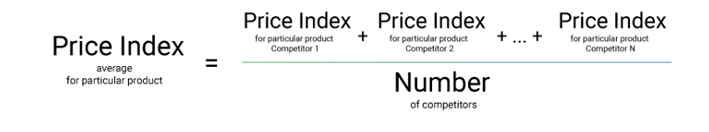

How is the cpi calculated? To find out your competitive price index, you can use the following formula: divide the sum of the received price indexes by the number of competitors.

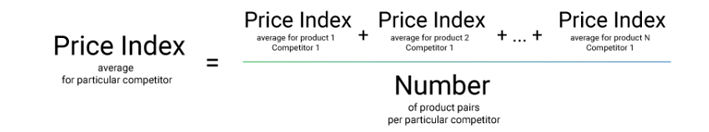

Lastly, to see how competitor prices influence your sales, you need to determine the average price index for each competitor. This can be calculated by the following formula:

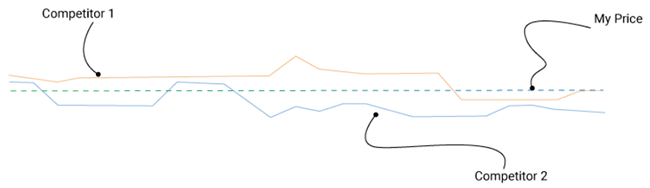

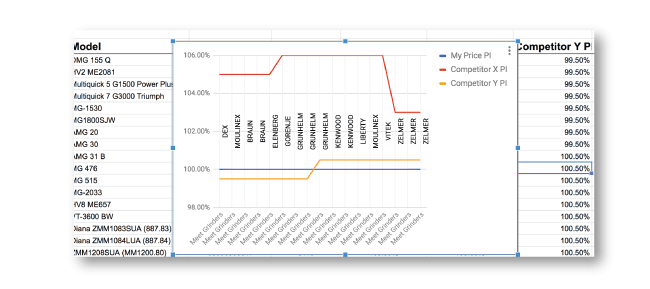

Now you can visualize all the data you’ve calculated onto a graph to discover all the deviations.

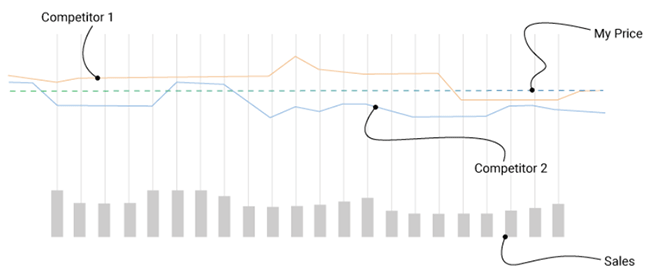

If you add your sales metrics to the same graph, you’ll be able to easily define which competitors impact your sales (in the graph below, Competitor 2 is the most impactful).

Going through the outlined workflow requires time and effort. The manual calculation of the average price index formula is, therefore, acceptable only for a limited group of retailers working with a few SKUs with relatively stable prices and demand. As a retailer reaches a particular size or maturity level, the automation of pricing-related operations becomes inevitable.

Example of How to Calculate CPI Formula

Let's look at a real-world example involving well-known retailers to understand how the Consumer Price Index (CPI) works and how to find CPI. Imagine Walmart tracking the cost of a typical shopping basket containing essential items like groceries, toiletries, and cleaning supplies. Last year, the basket cost $200, but this year, it costs $220. The price increase indicates a rise in the CPI, signaling inflation for these goods.

Similarly, consider Target, which monitors the cost of a basket filled with apparel, home goods, and personal care items. If the price of this basket rises from $150 to $165 over the same period, the CPI for those items reflects a 10% increase. These CPI examples show how to calculate the CPI so that by analyzing shifts in consumer prices, you can make strategic decisions.

Now that you know how to get CPI, the next question is who calculates CPI? While national agencies like the U.S. Bureau of Labor Statistics handle official calculations, retailers use their own CPI assessments to understand market trends. By calculating CPI, companies like Amazon track changes in their product categories and adjust prices to remain competitive. Knowing how to calculate consumer price index helps businesses measure the impact of inflation, forecast trends, and optimize their pricing strategies effectively in a fluctuating market.

So How Exactly Can a Retailer Calculate The Price Index?

There’s a simple flow you can follow to calculate the Price Index using the above formulas.

-

Collect fresh and accurate competitive data on prices and stock

To get a reliable result, you need to use reliable raw data. This is why it is essential to monitor competitor’s prices and stocks on a daily basis. For some industries, e.g. electronics, it’s necessary to monitor prices multiple times per day. Otherwise, your data is likely to be outdated and you’ll be comparing yourself to competitor prices that no longer exist.

-

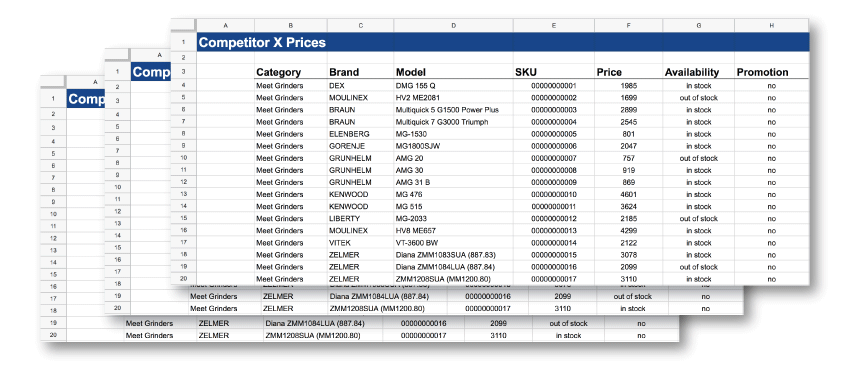

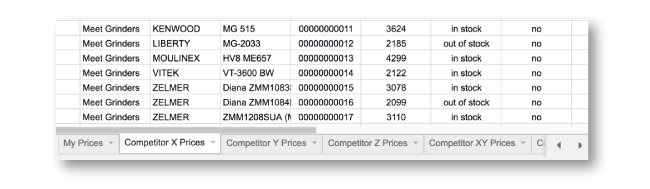

Create a Single Spreadsheet With All the Data You’ve Collected

In order to manage your data, you need to store it in a single place.

-

Apply Formulas From the Previous Paragraph

So long as you’re already familiar with MS Excel or another spreadsheet-building software, applying formulas to your data in your spreadsheet should not be too complex of a task.

-

Build a Chart

This bullet point is not obligatory, but very useful to better visualize deviations and recognize the dependencies between competitor’s changes and your sales results.

-

Add All Your Sales Data

As we mentioned before, the Price Index is useless without sales data. The Price Index shown by itself will give you market data but will tell you nothing about market impact without sales data.

-

Discover the Exact Activity That Affected Your Sales

With all of this information properly calculated and demonstrated, you’ll be able to see what and who affected your sales at a given time.

Complexity of Calculation

Implementing these calculations is easier said than done.

The first issue retailers usually face is regarding data quality. Some of them grab data from marketplaces, instead of taking data from their rival’s website directly. Other companies use self-made parsers. Some hire people to scrape data manually or buy cheap solutions that deliver low-quality data. This low-quality data often leads to poor pricing decisions.

However, even if you resolve any issues regarding data quality, you may still have problems with data processing or analysis. Errors caused by human factors can occur at any stage of this process; during data collection, its consolidation, analysis, or your repricing process, for example.

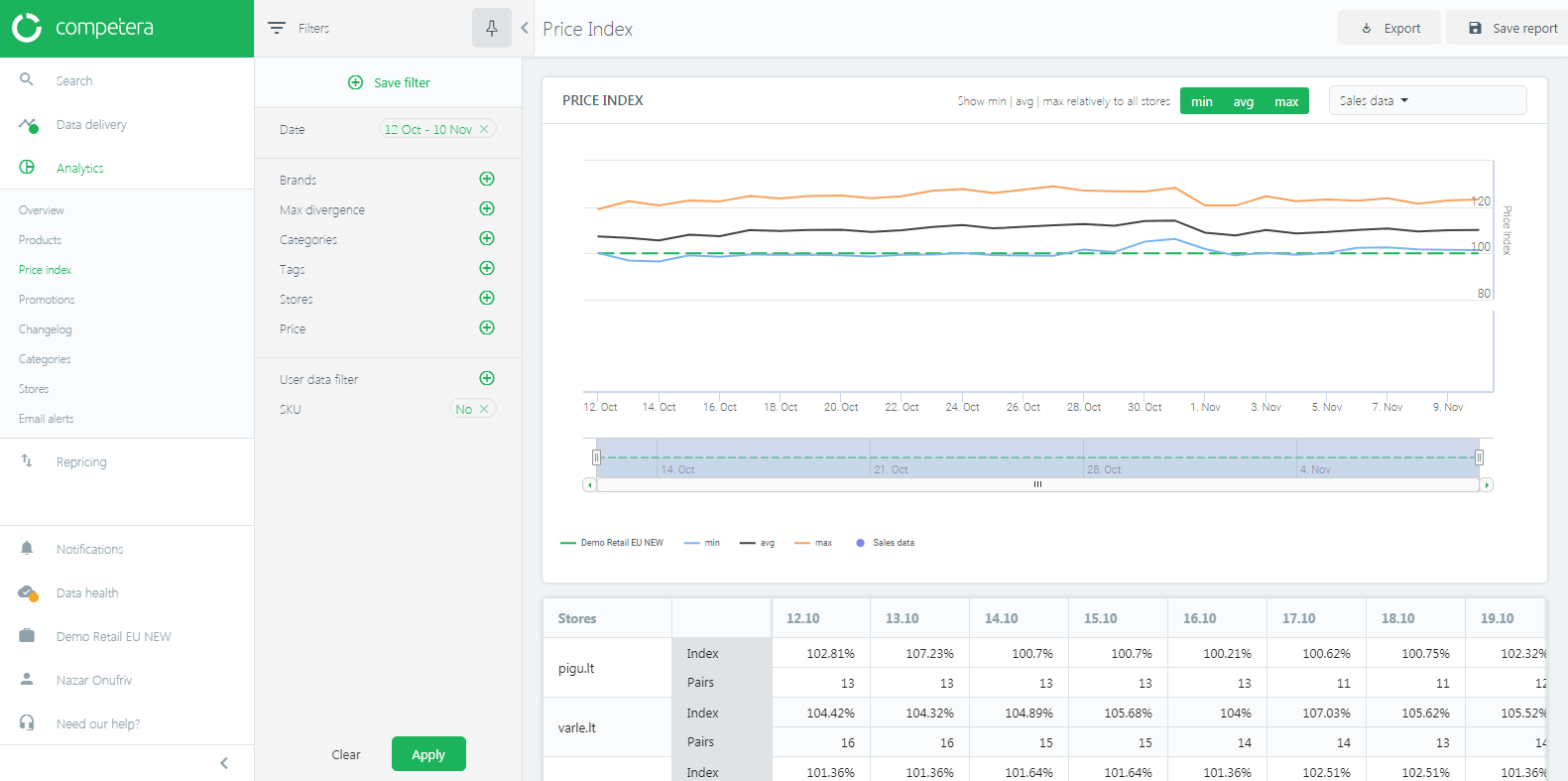

We, at Competera, provide businesses with pricing data with an accuracy of up to 98%. What it means is that our clients get fresh and correct information about prices, promos, availability, product visual representation, customer reviews, and other data from competitors’ websites. The data is processed and analyzed by our pricing engine to build the graph of the price index. The image below shows an example of how the price index is visualized in the software's interface.

With Competera Pricing Platform, category managers get a comprehensive market vision and a precise understanding of the real assortment intersection with other retailers which helps to identify your direct competitors. If you define your key competitors correctly, you’ll be able to choose the best products for promotion, set competitive-yet-profitable prices, forecast demand and inventory, increase total sales by driving associated products, and much more.

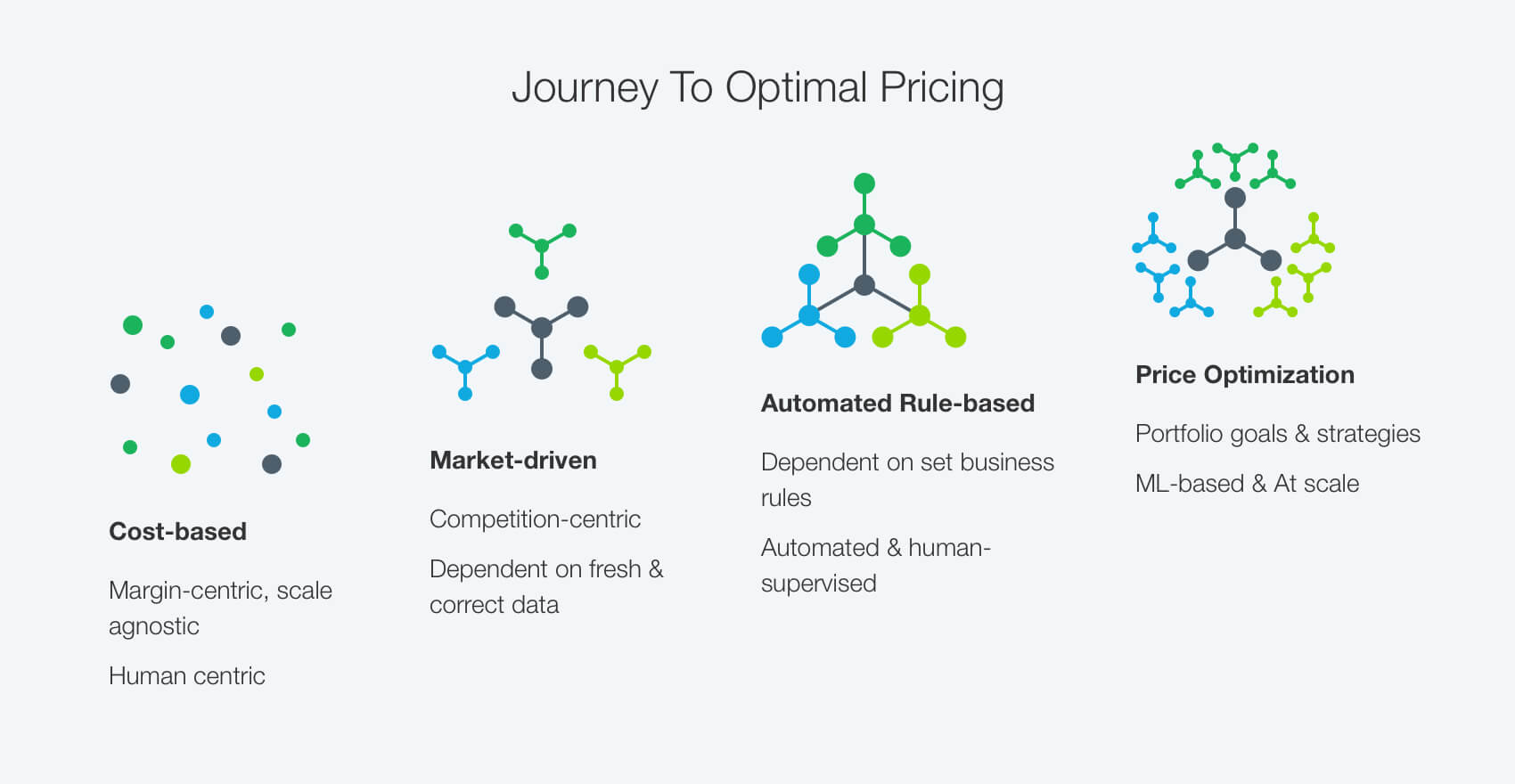

Сomprehensive, fresh, and accurate pricing data is fundamental as it enables retailers to grow strategically by further implementation of automated pricing rules and price optimization.

Using traditional and market-driven pricing can hardly help retailers to keep up with the rapidly changing retail environment and growing competition. At Competera, we believe that the future belongs to proactive rule-based pricing and price optimization. The retail leaders are already shifting to portfolio-level pricing with goal-driven scenarios based on ML/AI models.

No time for waste. Go beyond the knowledge of how to find consumer price index and discover demand-based elasticity pricing to optimize your pricing strategy, align an assortment with the current customer needs, and make smarter business decisions!

Who Uses CPI?

The Consumer Price Index (CPI) is a crucial metric for various stakeholders in the retail economics. Internally, retail teams like pricing analysts, financial planners, and product managers rely on CPI data to make informed decisions. For instance, pricing analysts use the CPI calculation formula to adjust prices per market trends. By knowing how to compute CPI, these teams can ensure competitiveness without compromising profit margins. Product managers also leverage CPI data to identify shifts in consumer spending, allowing them to optimize product offerings.

Externally, stakeholders like investors, suppliers, and policymakers utilize CPI for broader economic analysis. For example, suppliers might assess a retailer's pricing strategy using CPI examples to negotiate better contract terms. Investors monitor CPI trends to gauge the retailer's performance in inflationary periods, while policymakers analyze how the CPI is calculated to develop economic strategies.

Retail leaders often share CPI-based insights to demonstrate transparency and market awareness. Understanding how to measure CPI allows businesses to align with consumer expectations, predict demand changes, and adjust marketing campaigns effectively. Whether internally or externally, being aware of how to find cpi formula is essential for navigating the complex dynamics of retail pricing and market competition.

FAQ

Price Index is a normalized average of price relatives for a particular category of products or services in a specific geographical region for a given period.

Consumer price index marks the average prices of a basket of consumer goods and services provided to customers (e.g., delivery, shipping). To calculate the consumer price index, you must consider price changes for each product in a basket and average them.

The first step in constructing a price index, such as the Consumer Price Index (CPI), is selecting a representative basket of goods and services. This basket reflects the spending habits of a typical consumer or household over a specific period. Government agencies, like the U.S. Bureau of Labor Statistics, gather data on frequently purchased items, such as food, housing, transportation, and healthcare, to include in this basket. The selection process ensures that the index accurately represents consumption patterns. Once the basket is defined, the prices of these goods and services are tracked across different periods to calculate changes.

The Consumer Price Index (CPI) is typically calculated and published monthly in many countries, such as the United States. Some nations may release CPI data quarterly. The frequency depends on the statistical agency's methodology and the need for up-to-date economic information. Monthly updates provide timely insights into inflation trends, allowing businesses to adjust pricing strategies and policymakers to respond to financial shifts. Retailers and analysts rely on this regular data to monitor market dynamics, ensuring their strategies align with consumer spending behaviors and economic conditions.

The formula for calculating the Consumer Price Index (CPI) is as follows: CPI = (Cost of the Current Basket ÷ Cost of the Base-Year Basket) × 100 This means you divide the total cost of a fixed basket of goods and services in the current period by the cost of the same basket in the base year. Then, multiply the result by 100 to express it as an index. This calculation helps measure price changes, indicating inflation or deflation trends.