Content navigation:

- What is price sensitivity?

- Why price sensitivity matters?

- Price sensitivity analysis: major factors

- How to measure price sensitivity?

- Manage price sensitivity effectively

What is price sensitivity?

Pice sensitivity is used to evaluate the way particular price points impact consumer purchasing behavior. Subsequently, being aware of the price sensitivity level for products in their portfolio, retailers can evaluate the percentage of sales that will be gained or lost at certain price points. Sustainable price sensitivity management implies setting prices that would both meet customer expectations and generate the expected level of revenue.

Also, price sensitivity is identified with the idea of elasticity of demand. In simple words, it can be described as a percentage of how much the desire to buy changes when the price changes. Therefore, the formula is:

In this article, we’re going to find why retailers should thoroughly consider price sensitivity and what factors are contributing to price sensitivity the most. Keep reading, and you’ll find out the practical ways to measure price sensitivity level along with the genuinely effective approaches to its management. Let’s get started!

Why does price sensitivity matters?

The majority of retailers are more or less frequently facing the situation when good products are ignored by consumers even though their price appears to be relevant and justified. Most often, the poor sales in such cases are the result of a too high price sensitivity which was not considered appropriately by the pricing and category management teams. What it means is that timely evaluation and effective management of price sensitivity is one of the crucial factors impacting retailers' financial health.

Price sensitivity helps to evaluate the product's real value which, in turn, reveals the shoppers' willingness to pay. Having identified the product's price sensitivity, retailers can predict the sales volume more accurately.

High price sensitivity means that customers are likely not to buy a product as they consider it to be unreasonably overpriced by the seller. The price increase for products with high sensitivity is, therefore, a measure of last resort.

Low price sensitivity entails that the high price is not likely to have a negative impact on shoppers' determination to buy the product. The lower the price sensitivity is, the more control a retailer has over consumer demand.

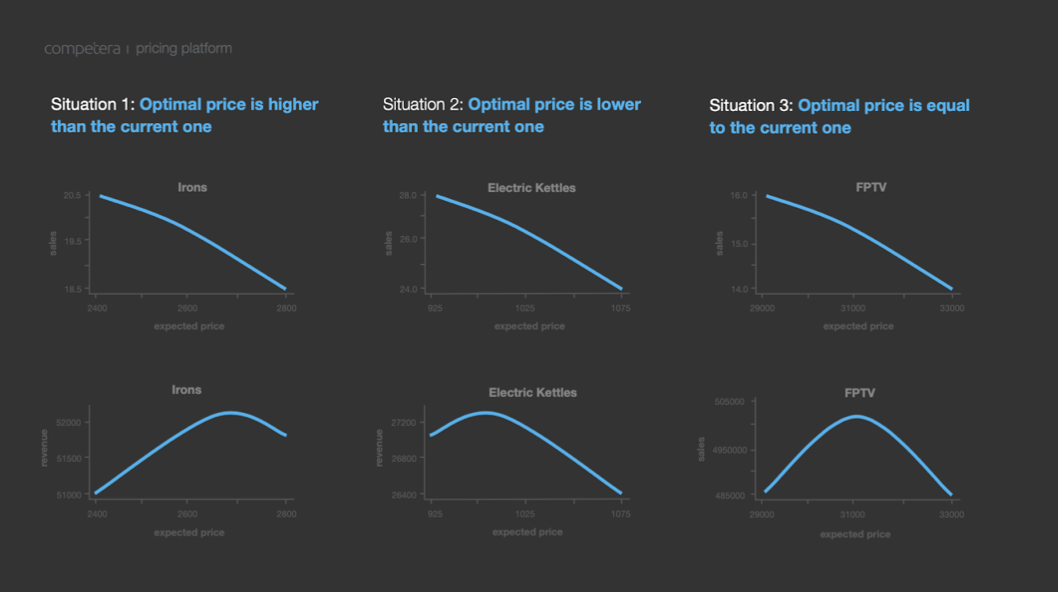

Finally, knowing the level of price sensitivity for a particular product allows retailers to set optimal prices across every category in their portfolio. On the graph below you can see how different pricing scenarios affect sales and revenue for three different products. Learn more at our free course at Competera Academy

Price sensitivity analysis: major factors

Price sensitivity is a complex phenomenon impacted by a wide range of factors, including industry, competition landscape, geographic area or customers’ psychology. To analyze price sensitivity comprehensively, the consumer decision-making project is worth being considered primarily. Kimberly Chulis from Core Analytics specifies the five-step model of consumer buying decisions:

-

Recognition of a need. Buyers realize that they need to buy a particular product to reach a preferred state. The recognition could be emphasized with advertising and other marketing tools.

-

Information search. Consumers conduct more or less profound market research on the market proposition.

-

Deliberation. Shoppers evaluate various options of making a purchase comparing alternatives available in the market. Price is the major factor considered at this stage.

-

Purchase. At this point, the byes a chosen product.

-

Post-purchase. Customers reflect on the shopping experience and decide whether to return to the buyer or not.

This model shows that customers are the most vulnerable to price sensitivity at the stage of deliberation. And that’s where retailers should convince customers that their offer is optimal. Speaking of factors impacting consumers’ price sensitivity at the stage of deliberation, three major points are worth mentioning:

-

Reference price. While making a buying decision, customers refer to prices on related products to benchmark the purchase.

-

Similar products. The more similar are the products under comparison, the more vulnerable to price sensitivity are the customers.

-

Brand perception. Loyalty to particular brands may turn out to be a significant factor that can either increase or reduce price sensitivity.

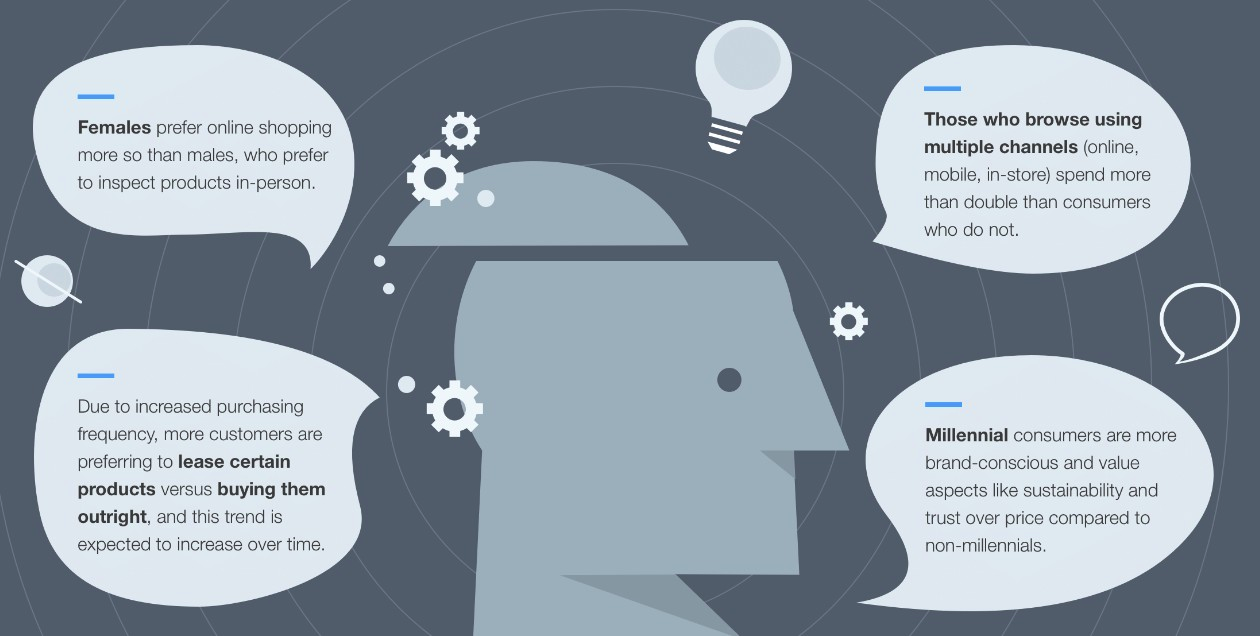

The awareness of consumer psychology patterns is crucial while analyzing price sensitivity. The visual below sheds light on some crucial insights into shoppers’ behavior today.

How to measure price sensitivity?

There are several approaches used by retailers to evaluate the level of customers’ sensitivity to particular price. In each specific case, the very process of price sensitivity measurement is defined by a range of targets, constraints, and tools available for a retailer. The most common methods include:

-

Research relevant data. Use historical data to analyze how similar products were sold in the past. Such research is especially useful in case of launching a new product.

-

Communicate with current customers. Social media or in-store polls are a good way to evaluate how customers value one or another product.

-

Track customers' online activities. For e-commerce retailers, the analysis of visitors' online behavior and, especially, conversion rate might be particularly insightful in terms of evaluating price sensitivity.

-

Read reviews and client feedback. Exploring people's opinions on particular goods is always a useful means of getting the first impression of price sensitivity.

The outlined above approaches may serve as rather general directions for retailers willing to get a starting point in measuring price elasticity. Now, let’s take a look at some of the more specific techniques to evaluate price sensitivity.

The first common method is price laddering. Price laddering entails asking customers to evaluate their willingness to buy a product at a particular price. In most cases, the 1-10 scale is used to measure the willingness to pay. Subsequently, if customers rate their interest lower than a particular point (for instance, '8'), the price is decreased until the customers' willingness to pay reaches the level desired.

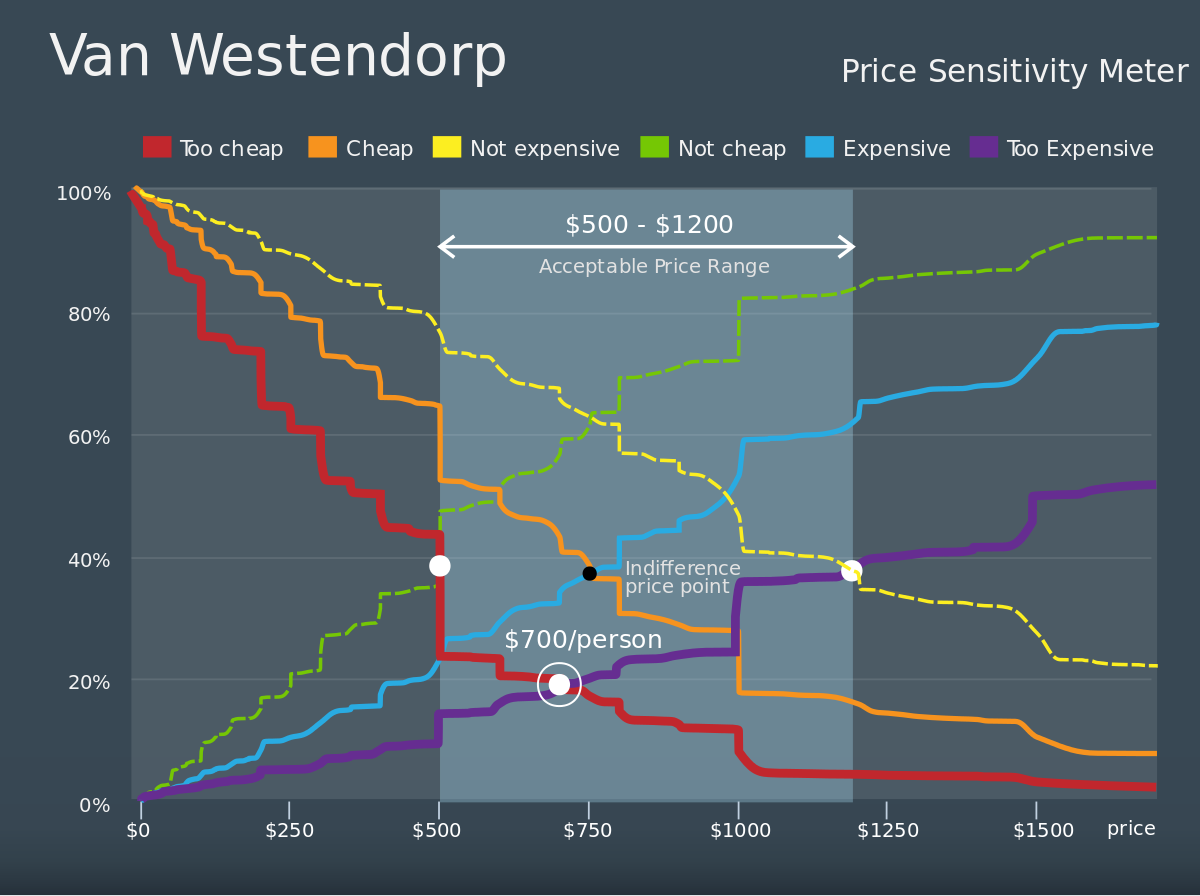

The price sensitivity meter is another popular approach developed by Dutch Economist Peter van Westendorp in 1976 to measure price sensitivity by means of asking customers a set of specific questions.

The questions proposed by van Westendorp might be altered slightly, yet in most cases, they go as follows:

-

At what particular price would you think that the product is too expensive?

-

At what particular price would you think that the product is probably of very low quality?

-

At what particular price would you think that the product is quite expensive, yet are still considering a purchase?

-

At what particular price would you think that the product is definitely worth buying as a perfect bargain?

After the answers are collected, retailers can craft prices that would both attract customers and, at the same time, maximize profit and revenue generated from sales.

Manage price sensitivity effectively

Sustainable management of price sensitivity is one of the major prerequisites underlying financial goals’ achievement and customer lifetime value (CLV) increase. Price sensitivity management is a complex process entailing already several fundamental aspects:

-

Strengthen your company's brand. If customers are to make a single choice out of the wide range of similar products offered on the market, the brand loyalty becomes the factor which defines a purchase decision.

-

Offer a unique and personalized shopping experience. Today, most marketers in retail are not satisfied with the level of personalization they offer to clients. Optimal price, personalized promo, and special offers are crucial to build a comprehensive and unconventional shopping experience.

-

Tell about the benefits that your customers can receive. It is not enough to craft the better offer, you must also be able to communicate it and deliver the message to customers.

To sum up, brand perception, personalized shopping experience, and communication with customers are the three pillars underlying the effective and sustainable price sensitivity management.

As we've mentioned already, the retailer's historical sales may serve as a remarkably useful source of insights regarding price sensitivity. Yet, on a scale of the whole portfolio, the human-centric analyses and evaluations are not only resource-consuming but also remarkably vulnerable to mistakes which means risks for the business.

In this regard, the advanced pricing solutions, like Competera's platform, are inevitable. Using state-of-the-art algorithms, Competera often identifies implicit relationships between the prices and customers' willingness to pay. Just one example to illustrate the difference between human-centric and tech-driven approaches: managers consider only 3 pricing and non-pricing factors at once while pricing software can process up to 60 factors impacting sales.

Each vendor has its own approach to help retailers managing price sensitivity. At Competera, we use the latest-generation deep learning algorithms capable of processing billions of data points to ensure the integrity of results with the price effect prediction accuracy of 90-98%. What it means is that retailers can stay confident that they would both reach their business goals and sustain the customers' loyalty.

FAQ

The high price sensitivity means that after a seller increases price, customers are likely not to buy a product as they consider it to be unreasonably overpriced. In other words, price sensitivity is high when a price change has an implicitly negative impact on demand.

Price sensitivity can be reduced primarily by effective management of reference prices for similar and supplemental products. In addition, a seller should also have an explicit vision of price points and price thresholds.