Content navigation:

- Big data: 21st century's business accelerator

- A short history of data use in pricing

- How to turn data into profits

- What's behind data-driven pricing

- Data-driven price recommendations in use

Every year, the amount of structured and unstructured data grows by 60% globally. That makes Big data a non-alternative domain for business decision making. Data is a powerful instrument that can boost bottom line metrics but only if treated in the right way.

If you're still doubting whether you should use Big data in pricing, the short and only answer is yes. Together with Wojciech Gorzen, a pricing expert with 20+ years of experience in profit and performance improvement, we will find out why disregarding Big data is a no-go and explore some practical ways it can boost your pricing performance. Let’s start with the basics.

Big data: 21st century's business accelerator

Big data is a complex phenomenon exploring and covering the most effective means to systematically collect, process, and analyze data sets that cannot be dealt with using the traditional approaches. It refers to both structured data from databases, as well as unstructured data from external sources, web, mobile devices, social media, etc.

In contrast to traditional data-processing approaches, Big data analysis is almost deprived of human involvement but, it also, implies using advanced algorithms and software capable of processing billions of data points within a short period.

Big data is considered to be one of the mega-trends defining global development in the 21st century. As it often happens, the business trendsetters have become the first to have realized the potential of using Big data. According to IBM, organizations applying analytics powered by Big data are 2.2 times more likely to sustainably outperform their industry peers.

The use of Big data has its distinctive features per every industry and retail is not an exception. As pricing has long been and will continue to be a core capability for retailers, it remains the major field in which data is used. Let's see how the data use in pricing evolved over the years.

A short history of data use in pricing

Even though the term Big data is said to be first coined by Roger Mougalas in 2005, the structured and unstructured data was used in pricing for decades. In 1985, the first yield management system was implemented by American Airlines, which can also be considered an early prototype of data-driven pricing. However, at that time, retailers relied mainly on consultancy agencies while developing a pricing policy. In practice, it meant human-centric pricing based on analytics processed and analyzed also manually.

Things changed in the 1990s when retail giants started to build their own in-house systems capable of storing and processing historical data. These solutions were still too slow in procession and integration and their effectiveness remained rather ambiguous. By 1999, global online sales reached the point of $20 billion so more and more data was available for the retailers. It was already clear that the future belongs to data-driven pricing.

In the first years of the 21st century, second-wave pricing solutions were presented. Data-driven rough predictions were now possible, but because of poor scalability it was not until the 2010s when the genuine pricing revolution became possible.

At that time, dozens of the so-called 'third wave' pricing solutions emerged offering a full range of pricing services powered with Big data. Now, depending on a retailer's needs and business maturity, it was possible to quickly and easily adopt any type of solution from a simple price scrapper to a complex engine predicting demand with 98% accuracy. The era of data-driven pricing has officially begun.

How to turn data into profits

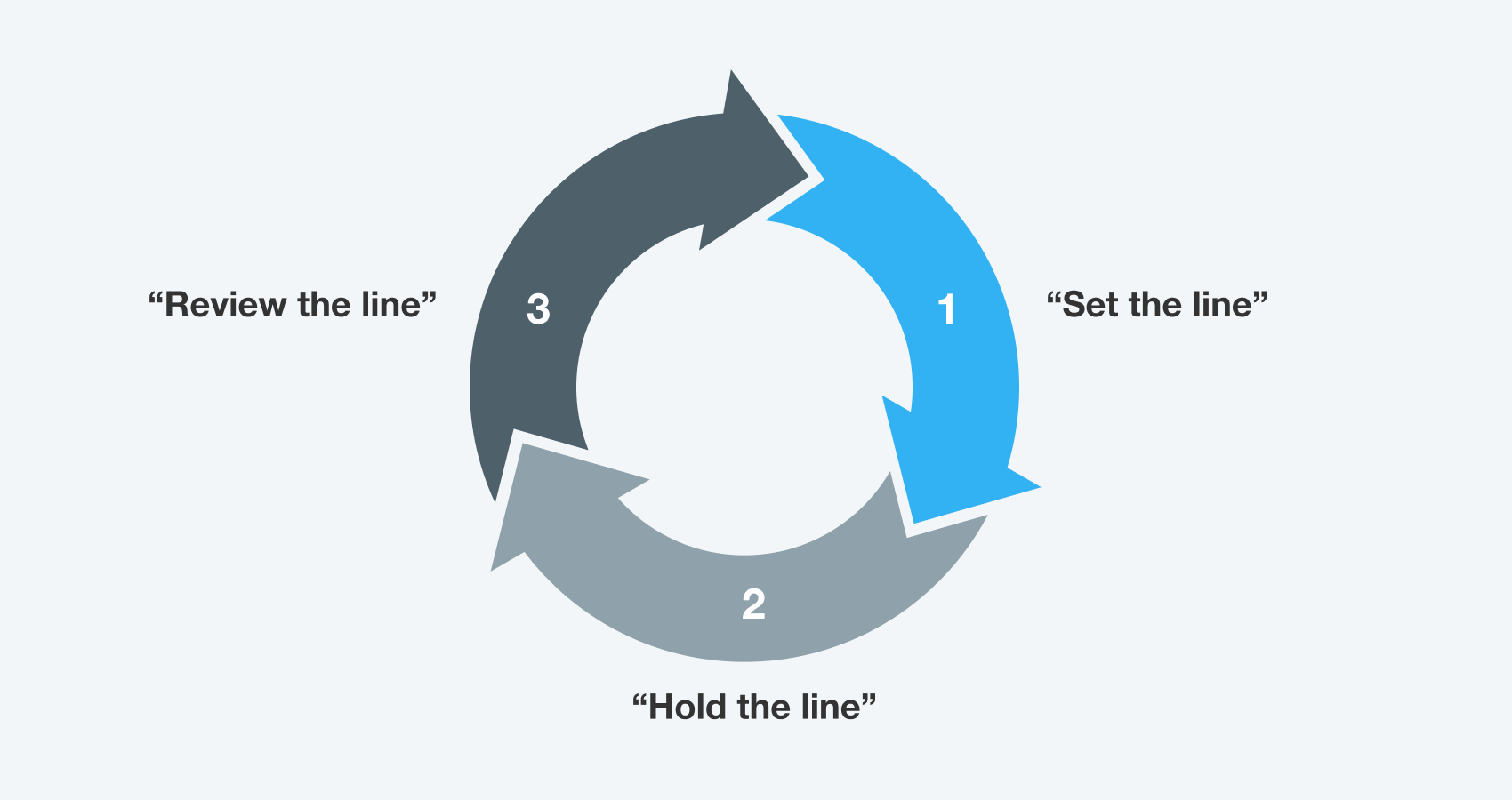

Before going into the details of how data should be used in pricing, let's take a step back to look at the successful revenue management cycle. The image below shows its classical three-step model of “Set -> Hold -> Review the line” as Wojciech Gorzen — pricing guru from Movens Capital puts it.

Now, what specific questions should you be asked at every stage of the cycle when it comes to pricing? We believe that these are the following ones:

-

How do we define pricing strategy?

-

How do we deliver pricing strategy?

-

How do we analyze results and redefine actions?

The answers will provide a direction and let you find how exactly should the data be used to reach particular business goals. The point is you may hardly turn the data into profits if no clear vision of every revenue management cycle stage was developed at first. Neither you can improve the strategy without outlining criteria for pricing performance evaluation.

You can’t control what you can’t measure. And you can’t manage what you can’t control. Hence you can’t manage or improve what you can’t measure.

When you’ve got the answers to these questions, you might ask ‘where and how do we get the data itself?’. Speaking of retail, there are three major data sources: business intelligence software, data crawling services provided by a third party, and retailer’s own data (e.g. sales and promo history, stock availability, etc).

When you’ve got the answers to these questions, you might ask ‘where and how do we get the data itself?’. Speaking of retail, there are three major data sources: business intelligence software, data crawling services provided by a third party, and retailer’s own data (e.g. sales and promo history, stock availability, etc).

Some retailers may rely on a single data source and it could be enough, especially, when a simple pricing strategy is used. But when it comes to large retailers applying sophisticated pricing logic or advanced strategies, the combination of sources is typically used.

Now, let’s take a look at some fundamental tips that can help you capitalize on pricing data. Walter Baker, Dieter Kiewell, and Georg Winkler from McKinsey give four essential recommendations to turn data into profits:

-

Listen to the data

-

Automate

-

Build skills and confidence

-

Actively manage performance

The first point is one of the ultimate importance: the data itself is not enough. You may have the most relevant and high-quality data but if it is analyzed manually, the efficiency would be little if any.

Big data should be treated with the corresponding analytical tools. In some cases building models in Excel might be enough but state-of-the-art pricing requires using AI-driven algorithms capable of gaining applicative insight out of the large volumes of data. The choice of a tool depends on the answers you’ve given for the three essential questions we’ve outlined above.

Automation enables managers to focus on strategic decisions rather than dealing with routine operational tasks. Shifting to automated pricing (data procession included) might take several weeks, but the results are worth it. Automation helps not only to reduce the repricing time by 50+% but also ensures error-free decision making and makes pricing configuration scalable.

Turning data into profit requires adopting new software solutions or integrating them into existing pricing systems. It requires the stakeholders and end-users to have a determination as well as certain technical skills needed to operate the software. Before making the solution available for large groups of stakeholders, test and fine-tune it with a small group of users.

Finnally, the need for proactive performance management should not be disregarded.You must have a clear vision of current business needs as well as the point you want to get. Prior to the implementation, develop a list of clear criteria and KPIs that will give you an answer if the right decision was made.

What's behind data-driven pricing

Depending on a retailer's needs and organizational maturity, the different types of data-driven pricing solutions would be more appropriate to use. For example, if you are aimed at boosting margin by at least 6+%, the solutions able to generate demand-based pricing recommendations on the portfolio level are worth being considered. But if you need to price, for example, only part of the assortment (e.g. Key Volume Items or KVIs) in regard to competitors' prices, you would need fewer data and a more simple solution.

Let's take these two specific requests as showcases and see which data is needed in each example and how it is processed by a pricing solution.

To price products based on competition, a pricing solution would rely on a combination of machine learning and a cascade of automated pricing rules. An auxiliary ML algorithm using Graph Theory and causal reasoning identifies a retailer’s competitors and potential KVIs. Afterward, price recommendations are generated based on the logic set per every product group or type.

In most cases, the data used in such case includes product list, current prices, and competitive data. You may also incorporate into the system any additional data to be used while repricing (e.g. stock levels, sales volumes, eCommerce traffic, promotions, etc).

In case your business goal is sustainable and long-term margin growth, a more sophisticated solution is required. The latter should be based on a demand-based pricing engine powered with neural networks measuring products' own price elasticity and cross-elasticities to ensure that goals on both the product and the category level are achieved.

Such engines can generate optimal prices on the portfolio level with the 95+% accuracy achieved through context-dependent price elasticities and a high-performance solver capable of shoveling through billions of possible price combinations to find the right one. To make it work, you will need to have historical data on transactions, promo calendars, price lists, inventory, and product reference tables.

Data-driven price recommendations in use

Real-life figures speak better than words. Let's look at some cases illustrating the practical implementation of the data-driven pricing as described above.

Speaking of the marked-based pricing request, the solution provided by Competera to Wiggle CRC, a leading UK-based online sports retailer, is a good fit. Competera helped the company to automate the entire pricing cycle so the time spent on repricing was reduced by 50%. Also, with a full view of the market, Wiggle implemented complex rules and pricing logic to price competitively over half a million SKUs. Switching to a smart data-driven pricing meant that the company’s margin was no longer diluted by following unnecessary competitors.

In this case, The use of data is worth special mentioning. Competera's solution enabled the retailer to add more sources of competitive data through reinforced marketplaces monitoring. Eventually, monitoring the marketplaces instead of competitors' websites not only meant getting more relevant and timely information but also reduced the costs of data collection.

Now, let's look at a solution provided by Competera for a large omnichannel electronics retailer. Avoiding profit margin losses was the major goal of the company. So, the solution providing regular demand-driven recommendations for price and promo decisions was implemented. Using diverse historical data, the algorithm generated optimal prices based on products' price elasticity and cross-elasticities within the portfolio. As a result, the retailer managed to sustainably increase its bottom line metrics: revenue by 13.6%, sales items by 5.8%, and transactions by 7.8%.

These cases show how the right technology combined with the relevant data can bring a retailer's operational and financial performance to the next level. Sure enough, the future belongs to data-driven pricing and it has already begun. Are you going to be part of this future?

FAQ

Cost driven pricing implies setting prices based on a product cost as a single factor.

'Data driven' is used to mark an action made with the use of data. If a retailer uses competitive data to set prices, then this approach could be marked as 'data driven'.