Content navigation:

- What is marginal revenue?

- Marginal revenue and other economic metrics

- How to calculate marginal revenue

- 3 examples of marginal revenue

- Why does your business need to calculate marginal revenue?

- Marginal revenue FAQs

Did you know that failing to track marginal revenue could lead to lost profits, even if your sales increase?

According to McKinsey, revenue growth is a critical driver of corporate performance. The marginal revenue metric also indicates whether you're selling SKUs at their optimal prices.

Understanding marginal revenue helps you strike the perfect balance between price, production or supplies, and demand. This article explains not only what is marginal revenue but also how to calculate marginal revenue and why mastering this metric is crucial for making smarter financial decisions.

What is marginal revenue?

Marginal revenue is the additional income you earn from selling one more unit of a product or service. It is a crucial concept in economics that helps companies, including retail businesses, determine the most profitable supplies or production levels.

So, how do you find marginal revenue? To calculate marginal revenue, businesses assess the total revenue change resulting from selling an extra unit. Here is a simple example of how it works: if total revenue increases significantly with the sale of an additional product, the marginal revenue is high; if it barely changes, the marginal revenue is low.

Marginal revenue is vital for pricing strategies and supply chain decisions, especially in competitive markets. For example, if a company notices that the marginal revenue of producing one more unit is lower than the marginal cost, it may reconsider expanding production.

In perfectly competitive markets, marginal revenue typically equals the product's price, but in monopolistic or imperfectly competitive markets, marginal revenue decreases as more units are sold due to pricing pressures. Let’s find out how to determine marginal revenue accurately and not get distracted by other metrics.

Marginal revenue and other economic metrics

Marginal revenue is just one of several key metrics that you can use to assess performance and profitability. Understanding how it interacts with other economic indicators, such as average revenue, total revenue, marginal cost, and demand, is essential for making informed decisions.

Let's compare these metrics to see how they differ and connect. If you know, for example, what is the difference between marginal cost and marginal revenue, you will also be able to find how to get marginal revenue correctly in every case.

Marginal revenue vs. average revenue

Marginal revenue is the extra income you gain from selling one additional product unit, while average revenue represents the revenue earned per unit sold. You divide total revenue by the units sold to calculate average revenue.

Again, marginal revenue equals average revenue in perfectly competitive markets because the price remains constant as output increases. However, in monopolistic markets, marginal revenue is lower than average revenue due to price reductions needed to sell more units.

Marginal revenue vs. total revenue

While marginal revenue is used to measure the additional income generated by selling one more unit, total revenue reflects the overall income from all sales. Total revenue is calculated by multiplying the price by the total number of units sold. The relationship between marginal and total revenue is crucial — marginal revenue shows how much total revenue changes with the sale of an extra unit.

Marginal revenue vs. marginal cost

Distinguishing between these two metrics can cause confusion. So, what is the difference between marginal cost and marginal revenue? Marginal revenue is earned from selling one additional unit, while marginal cost implies the cost of producing that extra unit. When marginal revenue exceeds marginal cost, a company profits from further sales. The point where marginal revenue equals marginal cost marks profit maximization. So, if you manage to align marginal cost and marginal revenue effectively, you can significantly improve the overall profitability of the business.

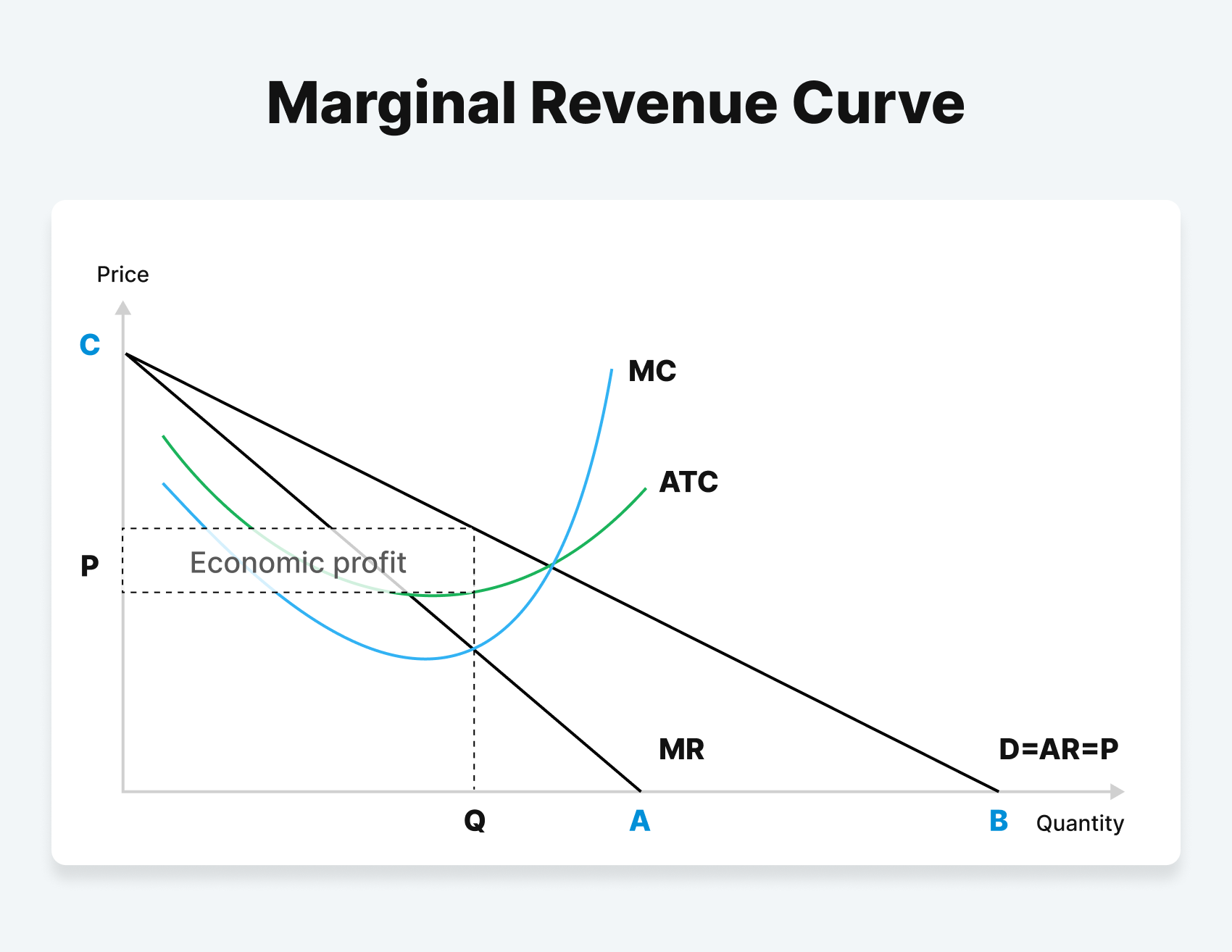

Marginal revenue curve vs. the demand curve

If you know how do you find marginal revenue, you probably noticed that the marginal revenue curve typically lies below the demand curve, as price adjustments are needed to increase sales.

This relationship is tied to the concept of price elasticity of demand. When demand is elastic, marginal revenue is positive, as lowering prices boost sales significantly. In case demand is inelastic, marginal revenue turns negative because price cuts lead to minimal sales increases.

How to calculate marginal revenue

Let's return to our main point: marginal revenue represents a company's extra income from selling one more product unit. Calculating it is simple: divide the change in total revenue by the change in quantity sold. Essentially, it's the selling price of that additional item.

Here's the formula of how to determine marginal revenue:

Marginal Revenue = (Change in Total Revenue) / (Change in Quantity)

To find the change in revenue, subtract the previous total revenue (before selling the last unit) from the new total revenue after the sale. You can also use this marginal revenue formula to assess revenue changes when scaling production.

In most cases, since the change in quantity is just one unit, the formula highlights the revenue impact of producing or selling that extra product. The proper use of marginal revenue formula helps refine pricing strategies, especially in competitive markets where price sensitivity can dramatically affect profits.

3 examples of marginal revenue

Being aware of how to calculate marginal revenue in theory is not enough. Understanding marginal revenue formula becomes clearer through real-world examples. Let's explore three scenarios demonstrating how to figure marginal revenue and use this metric to improve profitability and decision-making.

Example one:

A clothing retailer sells 200 jackets for $5,000. They decide to produce and sell 20 jackets more, generating an extra $400 in revenue. The marginal revenue is:

$400 (change in revenue) / 20 (change in quantity) = $20 per jacket.

Example two:

A toy store sells 50 action figures for $1,250. The store decides to sell one more action figure at a discounted price of $22. The marginal revenue from this additional sale is:

$22 (change in revenue) / 1 (change in quantity) = $22.

Example three:

A bakery sells 100 cakes at $40 each, earning $4,000. It lowers the price to $39 to boost sales and sells 101 cakes. The marginal revenue from the 101st cake is:

$3,939 ($39 * 101) – $4,000 ($40 * 100) / 1 = -$61.

Why does your business need to calculate marginal revenue?

Calculating marginal revenue is crucial for optimizing profitability and overall financial health. By focusing on the incremental income generated from additional sales, you can make informed decisions about production, supplies, pricing, and overall market strategy. Here are a few specific reasons why being aware of how to figure out marginal revenue is essential for your business.

Assessing the Financial Impact of Additional Sales

Understanding how to figure marginal revenue allows you to evaluate the financial impact of each extra unit sold. When companies sell additional products or services, they typically see an increase in total revenue. However, this increase also comes with additional costs. That's where the metric can help: marginal revenue measures the revenue gain from selling one more unit, enabling you to identify whether it's worth producing and selling that extra item.

It's important to note that marginal revenue often follows the law of diminishing returns. This principle states that the incremental output gained from each additional unit diminishes as production increases. Consequently, further production may not be beneficial, especially if the marginal revenue falls below the marginal cost. Therefore, businesses must not only know how to figure out marginal revenue but also track it regularly to sustain their optimal production level and save money on unnecessary outputs.

Evaluating Sales and Market Demand Dynamics

Calculating marginal revenue also provides insights into the dynamics between sales, market demand, and competitive positioning. While sales figures reflect the quantity of goods sold, market demand captures the broader desire for those products and services. Understanding this relationship is essential for retailers looking to grow and maintain profitability.

In perfectly competitive markets, marginal revenue equals the product's price, allowing firms to sell as much as they wish without adjusting prices. However, marginal revenue decreases in monopolistic or oligopolistic markets as production increases, requiring firms to lower prices to sell additional units.

Thus, businesses must know how to calculate marginal revenue to gauge how well they meet consumer demand and effectively navigate competitive pressures. This understanding informs pricing strategies and helps companies position themselves effectively in the marketplace.

Maximizing Profitability

Calculating marginal revenue is a fundamental practice for businesses striving for profit maximization. Companies should continue producing until the revenue from each additional unit (marginal revenue) equals the cost of producing that unit (marginal cost). This point indicates that the firm has reached its profit maximization level.

If you know how to find marginal revenue and it exceeds marginal cost, producing more units contributes positively to the bottom line. Conversely, further production will not result in additional profit once the marginal revenue equals marginal cost. Beyond this point, producing extra units can lead to losses.

Enhancing Pricing Strategies with Advanced Solutions

Speaking of what is marginal revenue in retail, its key relation to pricing is notable. Advanced pricing solutions help businesses identify the most effective pricing strategies that align with their marginal revenue objectives. By analyzing customer demand and competitive data, you can adjust the pricing dynamically to enhance sales without sacrificing profitability.

Tools like the Competera pricing platform enable retailers to analyze competitive pricing data, monitor market trends, and recalculate prices based on dozens of pricing and non-pricing factors in nearly real-time. Competitiveness therefore, implies knowing how to get marginal revenue and then use the advanced software to bring the gained insights into actions.

Using data-driven insights, you can understand the impact of price changes on marginal revenue and make informed decisions about when to adjust prices and by how much. This capability can provide a significant edge in a competitive environment, driving revenue growth and long-term sustainability.

Marginal revenue FAQs

What distinguishes marginal revenue from average revenue?

Marginal revenue refers to the additional revenue a company generates from selling one more unit of a product. In contrast, average revenue is calculated as the total revenue divided by the number of units sold. In other words, marginal revenue is the change in revenue resulting from the sale of an extra unit, while average revenue provides a broader view of revenue earned per unit.

What is the purpose of calculating marginal revenue?

Calculating marginal revenue allows businesses to evaluate the revenue from producing and selling one additional unit. This metric helps companies adjust their output to the optimal profit-maximizing level, maximizing their earnings from production or supplies.

How does marginal revenue factor into cost analysis?

Businesses focusing on profit maximization must understand how marginal revenue interacts with marginal cost. If you know how to find marginal revenue and marginal cost, you can pinpoint the production level that maximizes profits, which occurs when marginal revenue equals marginal cost.

What is the relationship between marginal revenue and the demand curve?

Marginal revenue generally lies below the demand curve and is influenced by the price elasticity of demand, which measures how the quantity demanded changes in response to price fluctuations. A positive marginal revenue indicates a high elasticity of demand, meaning consumers will buy more as prices decrease. In contrast, a negative marginal revenue suggests inelastic demand, where price changes have little effect on the quantity demanded.