Content navigation:

- What is market-based pricing?

- How market-based pricing is calculated?

- Market pricing 101: where to start

- Pricing KVIs: a market-based showcase

- Control the risks of market pricing

- Win over the crisis with Competera

What is market-based pricing?

Market-based pricing is an approach used by retailers to price products considering primarily competitor prices and other market data. Depending on the business strategy, brand and price positioning of a retailer, products could be priced somewhat higher or lower than competitors. The point here is that market data is the major contributor and core reference point while crafting prices.

Now, when markets around the globe are facing the devastating economic impact of the Covid-19 pandemic, retailers have to adjust their business models and strategy to the new context. As more players move sales online, the competition intensifies. In the light of crisis, smart market pricing becomes a key not only to survive the pandemic, but actually thrive during the crisis and afterwards. For example, Competera has been helping leading UK-based online sports retailer WiggleCRC Group to increase market coverage, reduce pricing effort by 50% and handle more complex pricing rules and logic. You can read the case study here.

In market-oriented pricing, competitive data plays a more important role compared to other pricing use cases, e.g., markdown or demand-based pricing. That's why this approach is closely linked to competition-based pricing which is also oriented on market trends and other players' policies.

How market-based pricing is calculated?

If a company is positioning itself as a premium retailer with a range of additional client services to provide the best shopping experience, its prices are likely to be higher than market average. In this case, the generalized pricing formula might look as follows.

The ‘market factor’ in the formula covers competitive and other market data considered by a retailer while ‘premium factor’ marks the money equivalent charged by the business for premium customer services. This simplified formula might differ depending on the retailer's positioning, e.g., for a discounter, the premium factor will not be considered at all.

Market pricing 101: where to start

Of course, the choice of a pricing strategy as well as tools for reaching business goals depends on a retailer type, market, industry, and range of other factors. Yet, almost in every case, the retailer has a group of products in the portfolio that must be priced with regard to competition. In this light, market-oriented pricing comes as an inevitability. The start pricing products based on market trends, you might need the following:

- Relevant sales and competitive data

- Historical sales and competitive data (preferably)

- Checklist of all variables you'd like to take into account in pricing

- Other data based on the checklist (e.g. Google Analytics data, promotion, stock clearance attributes, etc)

The best way to reveal the capacity of market pricing is to consider it in regard to the missions of particular SKUs in your portfolio. Depending on the lifecycle stage along with internal and external business contexts, every product in the assortment has its role. And these roles might change with time. Effective, coherent, and sustainable pricing means two things: segmenting a portfolio depending on product roles and applying the right pricing approach towards each bucket.

At Competera, we help retailers to both scientifically segment products into different buckets (KVIs, Long tail, Cash generators, etc) and then apply the corresponding pricing strategy towards each. Click below to read more about SKUs’ changing roles and how technology helps to price them at every lifecycle stage.

Pricing KVIs: a market-based showcase

So, what kind of SKU should be priced with a market-oriented approach? The 'Best Price Guarantee' products, which most often are your KVIs, are probably the best example. Market-oriented approach could either be effective for other types of products, yet for KVIs it is a non-alternative option.

KVIs are high-velocity and often low-margin products in an assortment range. The importance of KVIs stems from the fact that they drive the price value perception more than any other group of products. Customers compare the prices on KVIs across the market to find which retailer has the best price. Even if you offer better prices for every other group of product except for KVIs, you would still lose revenue in the result.

This point shows why a market-based approach is essential in KVI pricing. To keep customers loyal and attract new shoppers, retailers should monitor how their competitors price corresponding products and then adjust own prices based on a market positioning strategy. It sounds simple. But it isn’t. Competitors monitor your prices just as you do. And lowering prices every time means an endless price war known as a 'race to the bottom'. Here we’ve come to the risks of market-based pricing. Let's look at them in more detail.

Control the risks of market pricing

So, how to increase market share and keep up with competitors without getting into price wars? To find the answer, we must look deeper into the reasons causing race to the bottom. There is no problem with tracking your competitors, however, issues arise if you try to follow too many of them or, what’s worse, monitor the market players that have almost no impact on your sales. And what if the competitive data you use is irrelevant or misleading? The good news is that advanced pricing software can tackle all of these challenges.

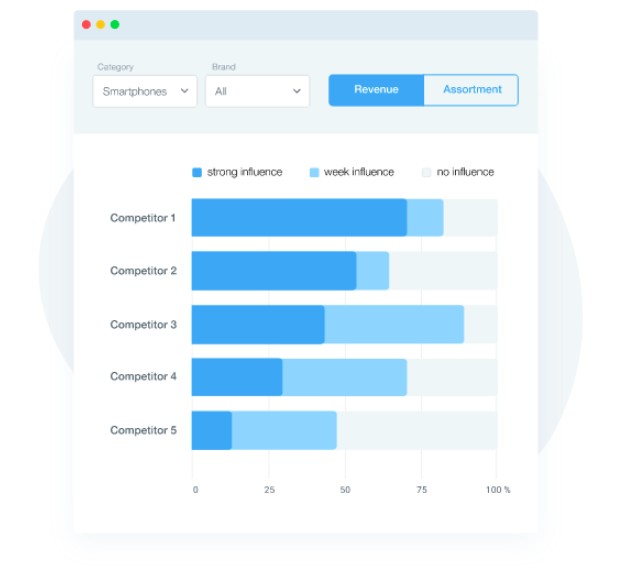

Identify ‘true competitors’ with Competera

Here is how we tackle these risks at Competera:

- First, the algorithm determines the level of negative impact every retailer has on your sales. Comparing competitors’ prices to your own prices and sales statistics, the platform identifies which market players are your true competitors.

- Second, ML-driven algorithms analyse the portfolio to segment products into buckets (KVIs, Long tail, Traffic generators, etc). Assortment segmentation is done by calculating both products own price elasticities as well as cross-elasticities between SKUs.

As a result, retailer can apply the right strategy per every product group and find which competitors are worth following.

Win over the crisis with Competera

In the beginning, we’ve outlined the generalized formula for a market-based price. It gives a basic idea of how competition-oriented prices are crafted, but it is too simplified to be used in practice. If you sell thousands of SKUs with dozens of different competitors within each product group, you need to have a scalable, adjustable, and self-service solution to ensure that your pricing is coherent, manageable, and transparent. And that’s what you get with Competera.

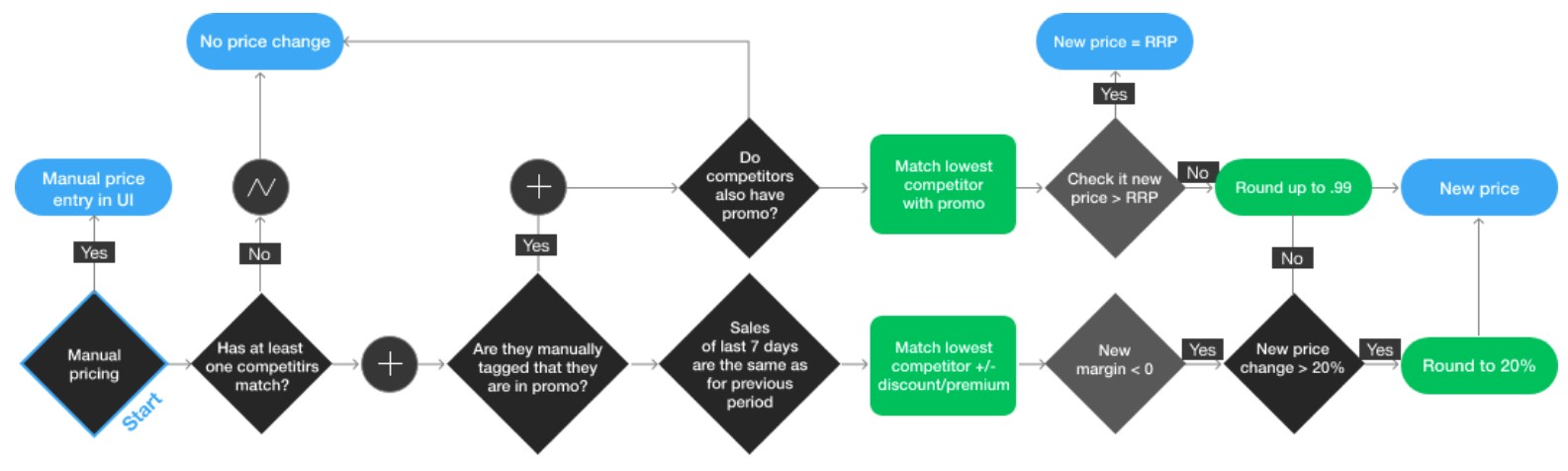

We’ve already discussed how Competera helps to identify the true competitors and segment products into different buckets. Now, you might think ”Okey, I know which competitors impact my sales the most and which products are the true KVIs, but how can I use this knowledge to get a competitive advantage and increase the market share?”. The short answer: you can reach these goals with pricing decision trees and smart rules. Let's make it more clear.

Example of an automated pricing decision tree

With Competera, retailers can use any variables to arrange customizable and automated pricing decision trees. You can set up pricing logic with diverse rules, parameters, or what/if scenarios based on promo, sales, cost, marginality, competitive data or any other variables.

Now, when retail industries across the globe are going through turbulence caused by the Covid-19 pandemic, the competition trends change drastically. It means fresh and relevant data becomes crucial. For those retailers lacking relevant data, Competera can provide high-quality product matchings and smart scrapping service as an optional complementary service. Using either internal or provider’s data, you can adjust common pricing rules from the platform’s library or create your own individually tailored rules.

Being aware of your true competitors and the roles of every SKU in portfolio, you can customize these automated rules to make sure only genuinely impactful factors are considered while crafting prices. You can easily modify the logic behind pricing decision trees or fine-tune separate pricing rules just as important changes occur at either your or competitors' side. In the face of crisis, Competera smart rules empower retailers to make a quick shift and take only right pricing decisions needed to stay competitive.

FAQ

The main purpose of market pricing is to help retailers keep their prices competitive and sustain the right price positioning against rival sellers.

Cost-based pricing is used mainly by newly established or small businesses as it is the most simple and easy-to-use approach.