Content navigation:

- What is annual recurring revenue (ARR)?

- Four reasons why understanding your ARR is so important

- How to calculate Annual Recurring Revenue

- Real-life Example of ARR Calculation

- Four ways to optimize your ARR

- What is the difference between ARR and MRR?

How confident are you in your revenue forecasts? ARR might hold the key to getting them right.

Annual Recurring Revenue (ARR) is a critical metric for businesses, especially those in subscription models, providing clear insight into growth potential and financial stability. According to research by SaaS Capital, SaaS companies with effective ARR tracking have more than 30% higher chances of surpassing their revenue growth targets than those that do not prioritize it.

However, miscalculations can lead to wrong projections and poor strategic decisions. This article will define ARR, explain the importance of understanding the metrics, guide you on calculating it accurately with real-world examples, and share actionable strategies to optimize it. You will also learn how ARR differs from Monthly Recurring Revenue (MRR). Let’s start!

What is annual recurring revenue (ARR)?

Annual Recurring Revenue (ARR) helps to manage the predictable, subscription-based income a business can expect to generate over a 12-month period. It reflects the revenue earned from ongoing customer contracts, excluding one-time sales or irregular payments.

Subscription businesses, particularly SaaS companies, use ARR to gauge their financial health, forecast future earnings, and plan growth strategies by providing a clear view of consistent, repeatable revenue streams.

Four reasons why understanding your ARR is so important

It’s not enough though to only define ARR. Understanding Annual Recurring Revenue meaning is crucial for subscription-based businesses, particularly those in the SaaS industry. It provides a clear and actionable view of the company's financial health and long-term growth potential. Here are four reasons why mastering ARR is essential:

-

ARR as a Benchmark for Tracking Yearly Progress

ARR is a powerful momentum metric that tracks your recurring revenue year over year, directly measuring your company's finance growth. By understanding the Annual Recurring Revenue meaning and continuously tracking the metric, you can see the impact of strategic decisions, such as new products’ pricing.

According to OpenView's SaaS Benchmarks Report, companies with above-average ARR growth rates are 50% more likely to exceed their annual financial goals. This is how ARR may become the compass guiding your company toward sustainable and scalable success.

-

The Foundation for Reliable Revenue Forecasting

One of the most significant advantages of ARR is its ability to create reliable revenue forecasts. By layering in factors like customer churn, upsell opportunities, and long-term pricing strategies, businesses can build accurate financial projections for the future. These insights help with strategic decision-making, making ARR an indispensable tool for growth planning.

According to McKinsey, AAR is a part of the rigorous financial analysis, which is essential for strategic success. Simply put, companies that effectively leverage ARR for forecasting are more than twice as likely to achieve consistent revenue growth than those that don't. ARR ensures you're not operating in the dark but with a clear vision of your financial future.

-

ARR Empowers Strategic, Goal-Oriented Decision Making

ARR provides a clear snapshot of your financial health, allowing you to set realistic, data-driven goals for the future. Whether it's growing customer acquisition, improving retention rates, or enhancing pricing strategies, ARR helps you pinpoint where your efforts should be focused.

ScaleXP states that ARR enables businesses to make more data-driven decisions, increasing the likelihood of hitting or surpassing their targets. Eventually, this level of insight enables you to take actionable steps that directly contribute to achieving your long-term business objectives.

-

A True Indicator of Business Stability and Health

ARR is a vital indicator of a subscription business's overall health. By focusing solely on recurring revenue streams, ARR excludes one-off sales and volatile income, giving you a true sense of financial stability.

ChartMogul SaaS Retention Report shows that businesses with a strong understanding of their ARR had more than 25% higher customer retention rates. This metric keeps you grounded in your business's performance, offering a precise measure of success and long-term sustainability.

How to calculate Annual Recurring Revenue

To calculate ARR accurately, focusing only on recurring revenues and excluding one-time transactions is essential. The calculation provides a high-level overview of your yearly income and allows for better forecasting and growth assessment. So, how do you calculate ARR?

The ARR Calculator Formula

Once you know how to define ARR and what are annual revenues, let’s explore the formula you can use to calculate the metric:

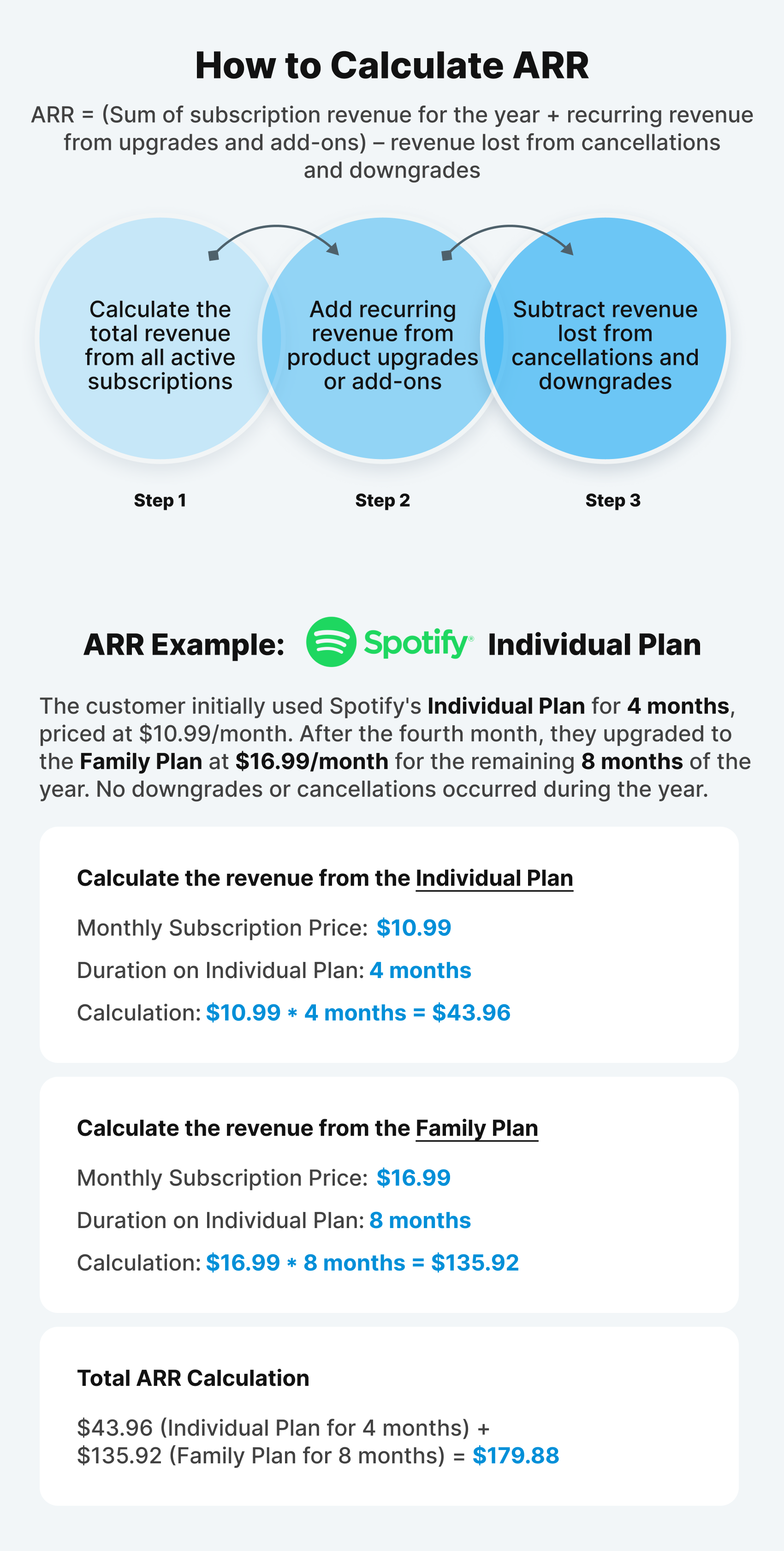

ARR = (Sum of subscription revenue for the year + recurring revenue from upgrades and add-ons) – revenue lost from cancellations and downgrades.

This calculation starts with the total revenue from all active subscriptions, including recurring income from additional services or product upgrades. You then subtract the revenue lost due to downgrades or cancellations. This provides a clear view of the revenue your company can expect from ongoing customer relationships.

Alternatively, for businesses with monthly subscriptions, ARR can be calculated by multiplying Monthly Recurring Revenue (MRR) by 12. However, this approach doesn't account for seasonality, upgrades, or downgrades that may affect the year-long subscription revenue, so it's better to use this as an approximation rather than a precise figure.

Understanding the definition of recurring revenue is essential to calculate ARR properly. The list of factors below will help you gain a complete understanding of what is recurring revenue.

Key Factors to Include in ARR Calculation

-

Annual Subscription Revenue. The core of ARR meaning is built on the total revenue generated from your annual subscriptions. This figure should encompass both new customer sign-ups and renewals. For companies using annual contracts, this is the foundation of the calculation.

-

Recurring Revenues from Upgrades and Add-Ons. Any recurring revenue generated from product add-ons, higher-tier plans, or increased usage should be factored into ARR. This includes customers who expand their subscriptions to access additional features, bundles, services, or more usage bandwidth. Remember that this is only for recurring add-ons, not one-time purchases.

-

Revenue Lost from Downgrades. It's also crucial to account for customers who downgrade their subscriptions. This reflects any decrease in revenue due to customers moving to a lower-tier plan or reducing their subscription's scope. While they haven't fully churned, downgrades still result in lost recurring revenue so you need to account for it to know exactly what is recurring revenue.

-

Revenue Lost from Churn. Churned customers represent a permanent loss of revenue. Include the full impact of customer churn by subtracting the total lost annual revenue from those who have canceled their subscriptions. Note that this should only include customers whose contracts have fully ended and cannot be recovered.

What Not to Include in ARR Calculator

When calculating ARR, it is essential not only to understand what are annual revenues, but also to exclude one-time fees or non-recurring charges that do not contribute to the long-term revenue stream. These exclusions are an important part of the full definition of recurring revenue and typically include set-up fees, non-recurring add-ons, credit adjustments, one-off discounts, and any other one-time charges for custom services.

Since ARR is focused solely on predictable, recurring revenues, incorporating these items can distort the accurate picture of your finance and lead to inaccurate projections.

Real-life Example of ARR Calculation

Let's take Spotify as an example of how to calculate Annual Recurring Revenue (ARR).

Spotify is a leading player in the music streaming industry using a subscription-based revenue model. With its freemium and premium tiers, the company generates significant recurring revenue, but to comprehend the company's financial health you need to have a clear understanding of what is annual recurring revenue.

Spotify offers several subscription plans: Individual at $10.99/month, Duo at $14.99/month, and Family at $16.99/month. Understanding and forecasting its ARR is key to Spotify's financial health, as it continually adjusts pricing and adds new features to attract subscribers.

As Spotify's CEO, Daniel Ek, said, "We're really investing in building a fantastic, multi-sided platform that has all the ingredients to become one of the truly unique creative platforms in the world."

Let's go through the ARR formula using Spotify's Individual plan to see how it plays out in practice.

Imagine a customer subscribes to Spotify's Individual plan at $10.99/month. After four months, the customer upgrades to the Family plan at $16.99/month for the remainder of the year, with no signs of downgrading or canceling.

Here's how the ARR breaks down:

-

Total $ amount of yearly subscription: $10.99 X 12 months = $131.88

-

Total $ amount gained through the Family plan upgrade: + $6/month for the remaining 8 months = $48

-

Total $ lost due to cancellations (churn): $0

Thus, the ARR for this customer is $179.88.

If Spotify has 100 customers who upgrade to Family after four months, the ARR for those customers would be 100 X $179.88 = $17,988.

This calculation showcases how Spotify's subscription tiers and upgrades directly contribute to their ARR. By tracking recurring revenue precisely, Spotify can accurately project its growth trajectory and adjust its strategies to maintain its competitive edge in the streaming industry.

Four ways to optimize your ARR

Optimizing your ARR is essential for maximizing the growth potential of your subscription-based business. ARR measures your company's revenue momentum and serves as a foundation for long-term scalability. Here are four specific strategies to enhance your ARR and drive sustainable growth.

-

Increase Net Customer Acquisition

Expanding your customer base is a direct route to boosting ARR. You can reduce the overall costs of acquiring each customer by improving your customer acquisition strategies and optimizing your Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio.

The key is efficiently bringing in more qualified customers, ensuring that acquisition costs remain low while the customer's long-term value remains high. A streamlined and cost-effective customer acquisition strategy will immediately impact ARR by driving more recurring revenues.

-

Expand Revenue Through Upgrades and Value Metrics

Maximizing expansion revenue from existing customers is one of the most effective ways to grow ARR. Encourage your customers to upgrade by aligning your product with value metrics highlighting additional benefits for higher-tier plans. Offer tiered services or additional features that provide real value to customers as they scale. Nurturing your existing customer base and offering relevant upgrades or premium features can significantly boost ARR without increasing acquisition costs.

-

Improve Customer Retention to Boost LTV

Customer retention is critical for ARR optimization. Retaining customers for a longer period directly impacts their Lifetime Value (LTV), increasing ARR. Focus on improving your product's alignment with customer needs and ensuring that you provide continuous value throughout the customer lifecycle. Strong retention strategies will increase your customers' longevity and overall satisfaction, leading to higher recurring revenue and reducing churn.

-

Optimize Your Customer Acquisition Costs

While customer acquisition costs (CAC) are not directly factored into ARR, lowering CAC allows you to achieve greater efficiency in driving recurring revenue. By refining your marketing and sales strategies and leveraging automation, you can bring down CAC. This efficiency translates into a higher return on every dollar spent, enabling more resources to be allocated toward activities that contribute to ARR growth, such as customer retention and product upgrades.

-

Optimize Your Pricing Across Channels

Optimizing pricing is another powerful means of improving ARR. By setting the right price points, businesses can boost customer acquisition, retention, and overall revenue per user. Advanced pricing software, like Competera pricing platform, uses machine learning networks to refine pricing strategies across channels and product groups, ensuring businesses are not leaving money on the table.

ML algorithms analyze vast datasets to identify optimal pricing points that maximize both customer value and profitability. AI-driven insights can help you balance between competitive pricing and profit margins, allowing for real-time adjustments based on market trends, customer behavior, and demand elasticity.

What is the difference between ARR and MRR?

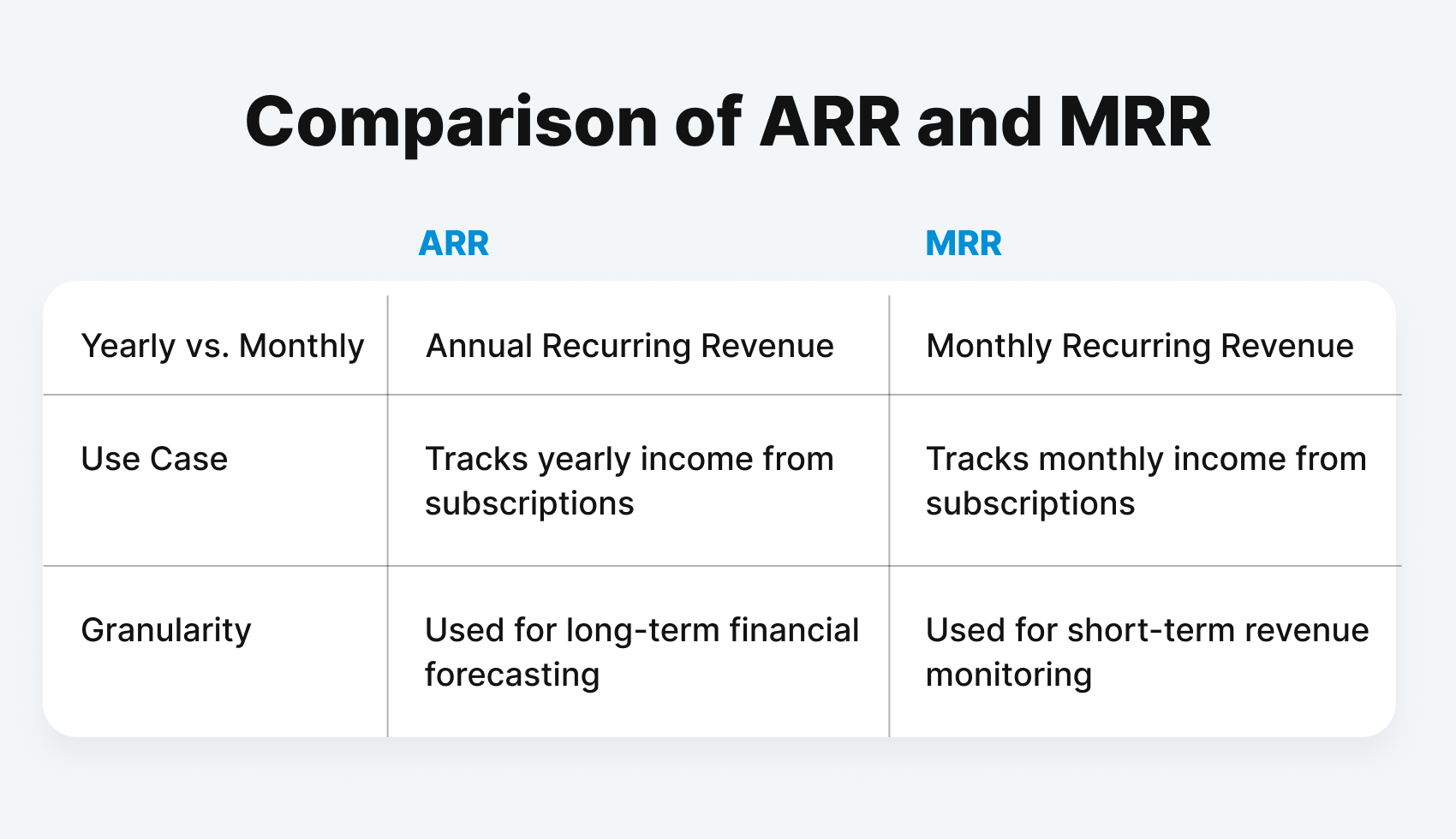

ARR (Annual Recurring Revenue) and MRR (Monthly Recurring Revenue) are both key metrics for subscription-based businesses, but they serve different purposes. ARR meaning implies the total recurring revenue a company expects to generate over a year, while MRR tracks monthly revenue.

ARR is a broader, long-term metric used for strategic planning, providing insights into yearly finance growth. It's beneficial for understanding a business's sustainability and trajectory.

MRR, on the other hand, offers a more immediate snapshot of business performance, helping companies monitor monthly revenue fluctuations, seasonal trends, or the impact of marketing campaigns.

While ARR is ideal for long-term forecasting and investor reporting, MRR provides a more granular view, allowing companies to make quick, tactical adjustments. ARR and MRR complement each other, offering a comprehensive picture of both short-term progress and long-term growth potential.

Conclusion

To sum up, understanding Annual Recurring Revenue meaning and optimizing both Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) are essential for the growth and sustainability of your subscription-based business.

By accurately calculating metrics and implementing strategies to enhance them, you can gain valuable insights into the health of your finance, make informed decisions, and drive consistent revenue growth.

Whether you want to refine your pricing strategy, improve customer retention, or optimize acquisition costs, having the right expertise is crucial. Competera's team of pricing specialists is here to help you navigate these complexities. We offer free pricing consultancy to assess your unique business needs and develop tailored strategies for maximizing your ARR and MRR.

Don't miss out on the opportunity to elevate your business — contact Competera today and take the first step toward unlocking your revenue potential!