Content navigation:

- What is behavioral economics and behavioral pricing?

- Behavioral economics in real life: facts and examples

- Behavioral pricing and retail: a win-win

- Behavioral pricing 101 or where to start

- Behavioral pricing 2.0

When hearing of behavioral pricing, most people think it is extremely beneficial to the business and devastating for the shoppers. Yet, the more thorough look at the topic reveals that the popular stereotypes about behavioral economics are rather misleading.

Prevailing consumer behavior patterns are a good illustration of how irrationally people may act. But disregarding behavioral science by retailers is even more irrational. It's time now to make knowledge on consumer behavior work for you.

Together with a Stanford guest lecturer in pricing Maciej Kraus, we’re going to explore all ins and outs of behavioral pricing to find what it really means for retailers and shoppers.

What is behavioral economics and behavioral pricing?

Behavioral pricing is an approach used to set prices based on consumer behavior patterns. Consumer behavior patterns are revealed by analyzing large volumes of relevant data (e.g. search and purchase history, click paths, demand trends, and demographical data, etc.). Behavioral pricing is a part of the broad concept of behavioral economics.

Behavioral economics studies the psychology of consumers and the way it impacts the process of economic decision-making. The practical dimension of behavioral economics is focused on finding ways to maximize profit using insights on consumer behavioral patterns and psychological motivations.

The origins of behavioral economics trace back to Adam Smith's The Theory of Moral Sentiments where it was first argued that an individual's concerns about justice are an important factor impacting economic decisions.

In the twentieth century, the concept gained recognition and true popularity. On the one hand, the theoretical works by Herbert A. Simon, Amos Tversky, and Daniel Kahneman revived the academic community and general public's interest in behavioral economics. And, on the other hand, the thriving development of information technologies opened the door for the practical use of behavioral economics in various businesses, including retail.

A best-selling book by Daniel Kaheman and the 2012 winner of the National Academies Communication Award for best creative work promoting public interest in behavioral science

A best-selling book by Daniel Kaheman and the 2012 winner of the National Academies Communication Award for best creative work promoting public interest in behavioral science

The early 2000s were marked by the increasing role of big data in the business decision-making processes. Erick Schmidt, a former CEO at Google, once said that we create as much information in two days now as we did from the dawn of man through 2003.

The businesses got billions of data points revealing the customer behavior on their websites. And within a short time period, the first algorithms predicting demand based on historical data were developed and tested. And that’s when a behavioral approach has become a self-sufficient pricing strategy.

Behavioral economics in real life:

facts and examples

The skeptics tend to criticize behavioral economics arguing that the economic agents act in rational terms. For better or worse, reality shows that most of the decisions taken by human beings are motivated by irrational factors. And the more irrational are the decisions, the more desperately people search for objective reasons to justify their behavior.

The businesses are already using behavioral economics extensively and if you want to succeed in the modern world, you must take it into account too. The pricing approaches used by the world-leading tech companies, like Apple Inc., may serve as a perfect illustration. While releasing the 8G iPhone in 2007, the company has set an introductory price of $600. But shortly after the release, the price was reduced to $400.

The quick price reduction was not a mistake. By introducing the phone at an unreasonably high price, the company made customers believe that a 400$ price was an exceptionally good deal. That's how pricing psychology works in practice.

In his TED-talk on behavioral economics, Maciej Kraus gives another good example of how our biases impact decision-making. Here it is: a coffee shop used to offer a small and large coffee priced $3 and $7 respectively. At that point, 87% of consumers preferred to have a small coffee while only 13% bought a large one.

Then, a mid-sized third option priced at $6 was introduced. After that, 74% of consumers started buying large coffee for $7 while only 26% remained loyal to a small one. This case shows again how an artificially created impression of a good deal impacts our buying behavior.

Behavioral pricing and retail: a win-win

You're probably thinking that a coffee shop offers only a few types of drinks and even Apple sells a relatively limited range of products. At the same time, a retailer may operate hundreds and thousands of SKUs. The question is how behavioral pricing can be applied in the large retail business?

Twenty and even ten years ago, there was hardly an alternative to the manual work of a pricing analyst or manager capable of testing various pricing approaches to find how they relate to the changes in demand and business metrics. What it means is that retailers could have hardly scaled up successful behavioral practices to portfolio-based pricing.

Moreover, these very often the marketing or other departments’ specialists who were researching the effect that behavioral practices could have. So, for a long time, the pricing stakeholders had a little if any involvement in implementing and testing behavioral pricing models. The lack of relevant and high-quality data as well as dynamic algorithms capable of analyzing the large volumes of data was the biggest challenge at that time.

Things have changed as the third-wave pricing solutions emerged in the 2010s. These solutions were capable of processing hundreds of pricing scenarios using the combination of last-gen technology with the best econometric practices.

Behavioral pricing is already helping businesses to earn more money. But only advanced software can reveal its full potential.

Over 15 years of our experience in pricing we see that, implementing behavioral pricing techniques through advanced software enables retailers to gain from 3 to 25% boost in bottom-line metrics depending on the market segment. But before going into details of how pricing algorithms work, let’s look at where behavioral pricing begins.

Behavioral pricing 101 or where to start

People tend to think that behavioral economics is something that only the market giants, like Amazon or Apple Inc. can afford to rely on. However, there are plenty of simple, yet effective practices that all types of sellers can implement. Let’s look at the practical tips that can give a start to pricing optimization:

- The rule of three. Above, we’ve already demonstrated how introducing the third option may boost sales with coffee cups as an example. It’s always better to give at least three options for customers to choose from. You can call this model “good-better-best” or whatever you like, but you have to make sure that your customers are able to make choices themselves rather than being sold a particular option with no alternatives.

- Default nudges. Giving customers a range of options to choose from doesn’t mean you can’t nudge them to make a particular buying decision. In most cases, it can be buying either a better or the best option. Framing the price tag as the “best value for money”, “best offering”, etc. is a good illustration of how default nudges can be used practically.

- The attribute of “free”. No need to be a behavioral psychologist to understand how the word “free” works for shoppers. Give customers a chance to get a free recipe book when buying an expensive kitchen appliance and the sales will increase.

- Pricing thresholds. Pricing thresholds are specific invisible zones marked by a certain level of customers’ willingness to pay. For example, the majority of shoppers are ready to buy a medium-segment chocolate bar for less than 1 euro. And just as the price goes beyond 1 euro, the willingness to pay drops immediately. Being aware of the pricing threshold is crucial to maximizing margin while keeping customers loyal.

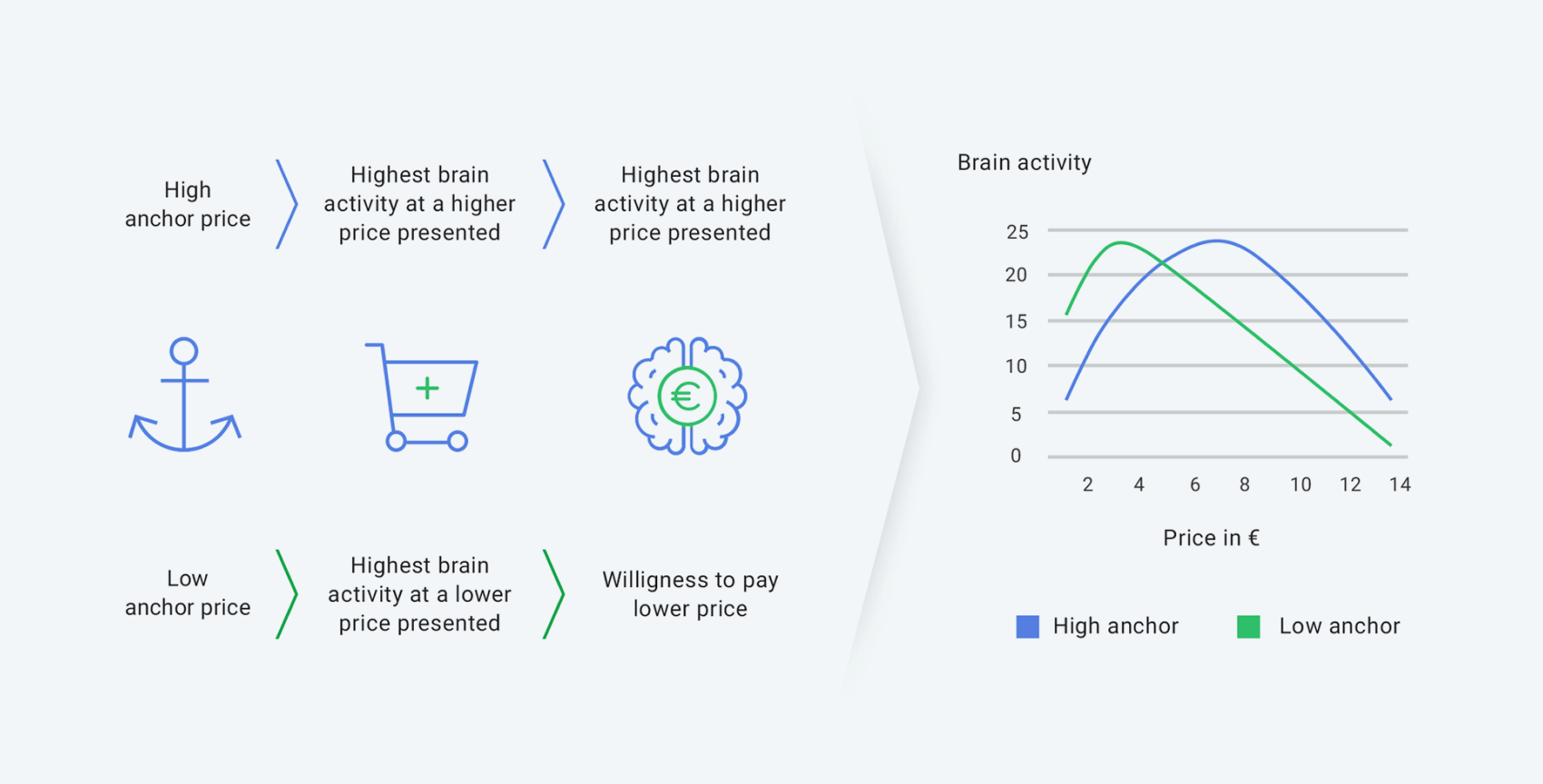

- Price anchors. The case of Apple Inc. introducing the new phone at an unreasonably high price to be lowered shortly after the release is a good example of how price anchoring works. Cross the initial high price and write down the more attractive one and you’ll see how powerful price anchors are.

The mechanism of price anchoring

The mechanism of price anchoring

-

Endowment effect. Receiving something more when making a purchase is a powerful motivation for every shopper. Getting the loyalty card, an ability to return or change a product, and other extra services create an additional value that the customers always want to get.

These are rather basic practices that may serve as a good starting point for a retailer willing to make pricing more effective. Even though these things have demonstrated their efficiency in practice, a retailer should always check and test whether they are coherent with a particular group of customers.

However, if you want to have an upper hand on the market and gain a real strategic advantage, these simple tips are hardly enough. To capitalize on the behavioral science in retail, you need to implement advanced ML-powered pricing solutions, like Competera. Let’s see how it works.

Behavioral pricing 2.0

In the 2010s, the advanced algorithms finally made it possible to implement behavioral pricing in a smooth, sustainable, and scalable way. To understand how it works in detail, it is good to focus first on the concepts of price elasticity and dynamic pricing.

Price elasticity depends directly on consumer psychology as it marks how the shoppers' willingness may change in regard to a new price. By processing billions of data points on historical sales, promo, and price changes, an advanced pricing engine can accurately measure the way demand for products will change in response to a price change.

At Competera, we use last-gen neural networks to define the precise product elasticity and, more importantly, cross-elasticities with other SKUs to ensure that the recommended prices help to reach goals on both category and portfolio level with no risks of dropping business metrics in a long-run. To put it simply, we gain insights into consumer behavior by analyzing the data and then use the identified relationships to craft optimal prices.

And here we approach a dynamic pricing concept, the idea of which is quite simple: just as consumer behavior changes, the retailer's prices should also change accordingly. Above, we've outlined the way cross-elasticities are identified but this only a part of the process our dynamic pricing algorithm goes through before generating the final price recommendations. Basically, the work of neural networks under the hood of the Competera platform could be divided into three major stages:

- The impact of cross-elasticities and dozens of other pricing and non-pricing factors is analyzed (e.g. promo attractiveness, positioning against competitors, relative price positioning within a category, etc)

- Bssed on a retailer's goal (e.g. profit boost, margin increase, etc), the best prices are recommended after processing millions of possible scenarios

- The algorithm generates a 5-8 week demand prognosis to make sure that the key business metrics are secured so strategic goals will be achieved by a retailer

In McKinsey’s 2020 ‘Retail reimagined’ report, it is noted that “providing personalized customer experiences — both in store and online — requires a deep and granular understanding of the customer and their decision journey — from zip code to zip code, and category by category — to quickly identify and predict where demand is going to surge or not.”

And this is exactly what Competera can do for your business. The platform collects all types of available data on consumer behavior, processes it with the last-gen algorithms to reveal even the most implicit patterns, and crafts the optimal prices that would both meet the customers expectations and maximize profit.

Want to satisfy the demand and keep customers loyal while, at the same time, sustaining the right price perception and growing sustainably? Our team of pricing architects is ready to answer all of your questions and show more opportunities that tech-powered behavioral pricing can bring to your business.

To conclude, those who think of behavioral pricing as a somehow discriminating approach may have a grain of truth on their side. But let’s put it in a different way. Behavioral economics is something that makes a personalized pricing possible. And, let’s be honest, it’s not so bad if the customers will always get the proposals they're willing to get while retailers will have loyal shoppers and excellent financial results.

_______________________

The article is co-authored with Maciej Kraus, a partner at venture fund Movens Capital and Stanford guest lecturer in pricing, earlier a Head of Sales Strategy and Revenue Optimization at PwC. Maciej is an author of “The Naked Mind-Shortcuts to Sales: Neuromarketing Overview for Profitability and Business Success”.

FAQ

Here is an example of psychological pricing: if the price for a large cup of coffee is only a little higher than the price for a middle cup, many buyers would still buy the large coffee even if they first intended to buy a middle or small one.

By processing billions of data points on customer behavior, historical sales, promo, and price changes, an advanced pricing engine can accurately measure the way demand for products will change in response to a price change.