Content navigation:

- Real-time pricing: embrace the inevitable

- ESL as a sign of the future

- What's wrong with ESL and real-time pricing?

- One more remark on pricing evolution

- When does real-time pricing work?

Which associations come to your mind when hearing the word combination "real-time pricing"? Some of you might think of the world's major Stock Exchanges with their large screens showing everchanging prices for the top-rank companies' stock. And this kind of association is pretty good to understand how real-time pricing works.

Some prices might change more frequently than others, but as a product attribute, the price could not be stable by definition. There are dozens of factors impacting the final price that shoppers see in a retail store. When one of these factors changes, it means that the 'old' price should be changed too.

But it takes time for a retailer to note a particular factor change, recalculate the new price, and deliver it to the shelf. Well, it used to take a lot of time. With advanced technologies, these processes can be done almost instantly. And that's why real-time pricing is no longer a futurist fantasy.

Real-time pricing: embrace the inevitable

If one would say to you that real-time pricing is already been actively implemented in retail, it would be a true statement. Just look at Amazon — the prices for some products may change a few times during one day or even one hour. And these changes, of course, are not managed manually. In most cases, sellers use more or less sophisticated rules and algorithms to keep their prices relevant to the most important pricing and non-pricing factors. For example, when the major competitors have a particular SKU out of stock, the price for it increases by X%.

Very often, the innovations are implemented extensively when the business has no other choice to survive. And that's exactly the case of real-time contextualized pricing. Eventually, the global economic crisis provoked by the CV19 pandemic in 2020 has significantly accelerated the trend of adopting real-time pricing. The pandemic made the competition so tough, that retailers could no longer neglect event-driven pricing powered by advanced technologies.

Limited in their ability to visit physical stores, consumers are eager to find the contextualized real-time experience online. Among other services and opportunities, this kind of shopping experience implies special offerings and promo per particular types of products. During the lockdown, retail app downloads have hit their highest ever level. Retail apps have become more than merely transactional facilities. When using apps, shoppers want to get special pricing offers based on their brand loyalty, past purchases, etc. And they want it in real-time.

According to Digital Commerce 360, between March 1 and May 18, there were 6.2 million downloads of Walmart’s main shopping app and 3.4 million of its grocery app. The mass use of retail apps breaks new ground in terms of real-time pricing adoption. Shoppers' mobile devices link directly the buyer and retailer enabling the latter to provide personalized offerings for different groups of customers.

As the cases we've mentioned refer to online sellers, some people might think that offline retail has little to do with real-time pricing. Fair enough, but not exactly true. Let's find how real-time pricing is becoming a part of the offline retail model.

ESL as a sign of the future

An electronic shelf label (ESL) system is used by retailers to display the current product price on shelves. Whenever a new price is generated by the pricing system, it is automatically updated on a shelf. The largest revenue share in the global ESL market is generated by five countries: the US, Germany, France, Japan, and China. According to Business Wire, the global retaill automation market is likely to reach the point of $23.2 billion by 2027.

Yet the CV19 impact on the ESL market remains ambiguous as, in a time of crisis, retailers prefer to invest in technology with a high ROI which is definitely not the case of ESL. But we'll return to this point a bit later.

In any case, electronic shelf labels are probably the most compelling symbol of real-time pricing embodying its' essential idea. ESLs mitigate any difference between online sellers, like Amazon, and offline retailers in their ability to change prices in real-time.

So, the instant new price delivery is the first and most important advantage of ESL. It also enables the business the optimize the workload of in-store personnel and reduce the costs spent on new labels' production. However, the cost-effectiveness of an ESL system implementation has also an opposite side. Let's find what it is.

What's wrong with ESL and real-time pricing?

Retailers decide to invest in a particular technology based on several factors, including a solution's ROI. Moreover, in the post-CV19 business environment, the role of ROI as a decision-making factor plays a crucial role. The recent research by Deloitte shows that 88% of retail executives name 'digital acceleration' as their top investment priority for 2021, 78% named either 'supply chain resilience' or 'health and safety', and only 72% of executives prefer 'cost structure realignment' as an investment priority for the next year.

However, even as a means of cost optimization, an ESL system implementation is hardly the most attractive option. Integrating and maintaining ESL requires a significant initial investment while the long-term cost-saving effect is rather moderate. That's why many offline retailers still prefer to use old-fashioned paper price labels. And relatively insignificant ROI is not the only reason for that.

It is important to understand that the concept of contextualized pricing is not yet finalized. Legislation and regulatory acts vary across national markets and, in many cases, it is unclear where the contextualized offerings end and price discrimination begins.

Many players also find it challenging to deal with various issues related to real-time price changes in stores. For example, a shopper might take a product from shelf at a particular price which is then different by the time of checkout. Thus, the risk of being alleged in unfairness by either customers or legal authorities is another reason preventing retailers from mass adoption of ESL systems and real-time pricing.

One more remark on pricing evolution

The challenges and issues associated with the real-time pricing were outlined to show that ESL systems and similar tools are neither a magic pill nor the necessity that every offline retailer must implement right now. The point is that retailers should be mature enough before the decision to implement an ESL system is made.

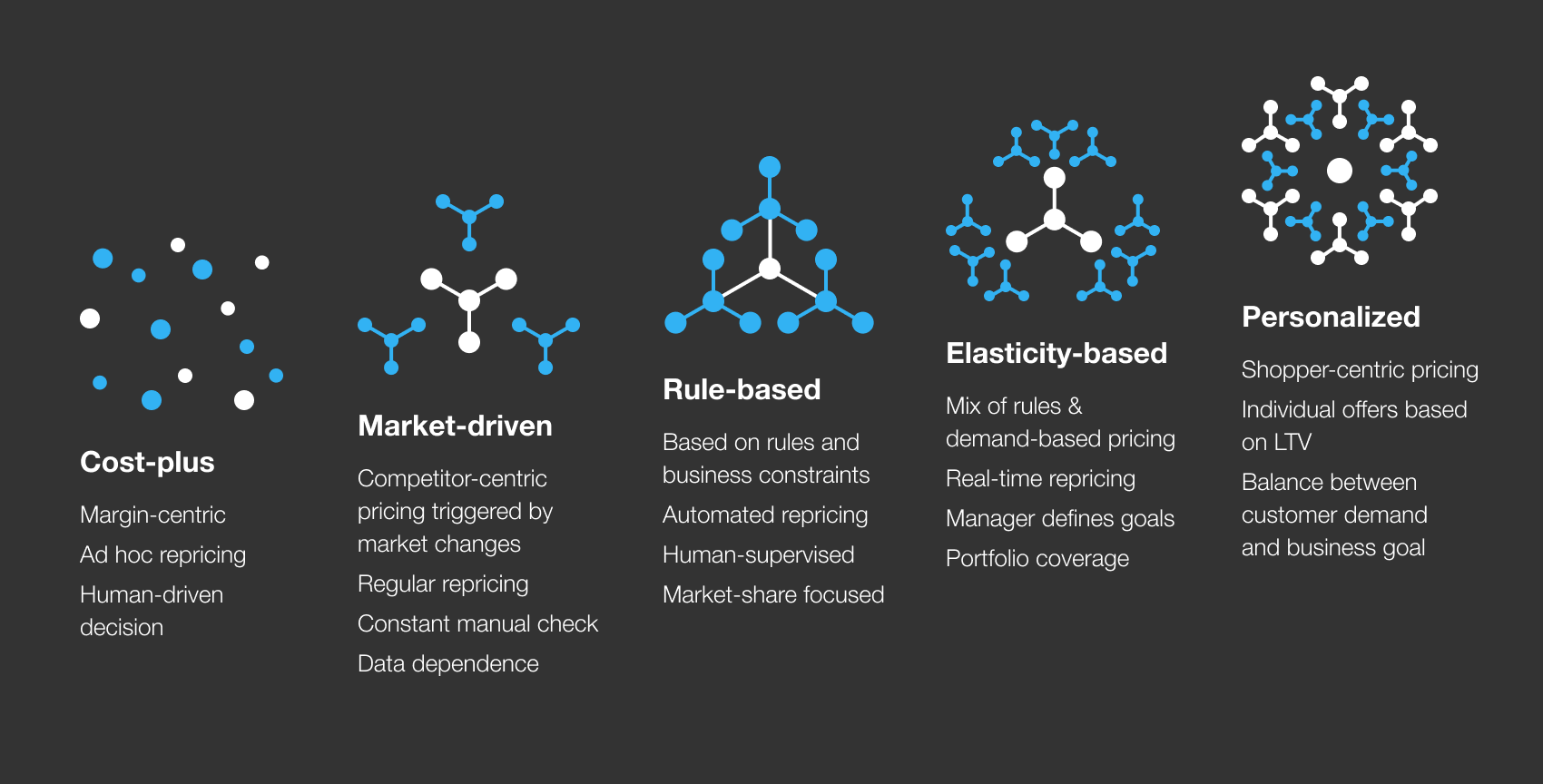

Let's look at the pricing journey's visualization below. The fact that personalized and contextualized pricing marks the highest point of the scheme doesn't mean that the evolution of pricing policy represents a linear process in which moving to the new stage means denial of the practices and approaches used at the previous stage. For example, shifting from a market-driven approach to rule-based or elasticity-based campaigns doesn't mean that a market-driven strategy should no longer be used.

Every new stage of the pricing evolution is rather a point where a retailer can diversify and extend the range of tools and strategies used in pricing. So, reaching the stage of contextualized pricing means that a company can use almost any combination of the pricing strategies with the most relevant approach applied to each product group and customer segment.

Moving to a contextualized real-time pricing with ESL systems or similar tools requires substantial financial and organizational resources. Let's see at which point considering an ESL system implementation starts to make sense for a retailer.

No doubt, the future belongs to electronic shelf labels. But as long as you don't have an advanced pricing solution behind an ESL system, it will bring little if any value.

When does real-time pricing work?

First and foremost, a business has to have a clear and mature strategy. It is not enough to say "we want to change prices as frequently as our Amazon-based competitors do", but it rather means answering the questions "why should I follow my competitors, which products and players are worth tracking, and is it really necessary to always look at the competition?".

Amazon-like frequent repricing is an illustrative phenomenon to give an idea of what does strategic maturity means. Gaining the market share, growing margin, or retaining customers are examples of strategic goals. In contrast, following the competitors is only a tool that might relevant to strategic goals but not always. This approach works as a good means of setting prices for KVIs or gaining the market share with new products but, in other cases, more sophisticated strategies are needed.

Besides, the product roles in the assortment change all the time. Yesterday's new entries may become cash or revenue generators today while the latter may turn into long-tail SKUs, etc. The point is ESL systems and other real-time pricing tools can bring the result only when applied to the right group of products at the right time. The question is how to identify these changing roles timely and accurately?

Here come advanced pricing solutions. Competera allows using the combination of last-gen machine learning algorithms, time-proven econometric methods, and Big Data to segment assortment into different buckets depending on roles played by each SKU. As a result, a retailer can identify which products are currently the true KVIs and apply to them a competition-based strategy with frequent price updates, which are then instantly delivered via an ESL system.

With a good pricing solution, a retailer can also be sure that the prices on the shelf are always right with no risk of getting involved in the endless price wars. That's because advanced algorithms used by Competera are also capable of defining the exact intersections with other players so it becomes explicit which particular competitors have a real impact on one or another KVI's sales.

In other words, the pricing solution prevents a seller from diluting margin by following unnecessary competitors. If you want to find more on how it works in real life, explore the case of Wiggle Chain Reaction Cycles: right before the CV19 outbreak, Competera helped the UK retailer to automate their repricing process and improve competitive coverage to make sure the prices are changed in time and without compromising on margin.

In conclusion, adopting real-time pricing tools without prior implementation of advanced pricing solutions would not only be ineffective but may even worsen the retailer's financial performance (e.g., by exaggerating price wars). In contrast, an intelligent pricing solution combined with an ESL system would create synergy turning retailer into a real trendsetter.

FAQ

Whenever a new price is generated by the pricing system, it is automatically updated on a shelf being displayed on an electronic shelf label.

Electronic shelf labels are aimed to ensure a prompt and smooth pricing implementation process.