Content navigation:

- What is price leadership?

- Price leader: when does it work best?

- Price leadership benefits

- Price leadership drawbacks

- Three price leadership models

- Price follower or sometimes it's better to look at the market

- Price leading vs. price following: what about synergy?

- How are price leaders made

What is price leadership?

Price leadership is a phenomenon that occurs when a particular seller can set a price which then serves as a benchmark for the other market players. In its broad sense, the price leadership concept includes three specific pricing models: the price leadership model itself, price followership model, and the cobmination of two. Generally speaking, setting prices for new product entries may be a good illustration of price leadership definition, yet the latter occurs not only when the new entry price is set or a unique product is introduced.

In some cases, predatory pricing might also be an example of price leadership model. Here's how it works: to get awareness and increase the customer base within the shortest time possible, a new market player sets the prices almost equal or even lower than product cost. As a result, the other players are forced to reduce their prices too, at least for particular types of products. The point is that price leadership definition does not necessarily imply setting the best or the highest price but is rather about setting trends which requires the competitors to react.

The phenomenon of price leadership takes place across various types of industries and markets. However, it is more common under specific circumstances. Here the ones that define price leadership:

-

A limited number of competitors

-

Products are the same or very similar

-

The demand elasticity is relatively low

The very idea of price leadership is more relevant for specific types of product due to their roles in the portfolio. We would not only comprehensively define price leadership but also give the examples and discuss how it works in the sections dedicated to a price leading and price following models.

Price leader model: when does it work best?

In many cases, price leaders are large retailers with a diverse portfolio, high turnover rate, and a substantial amount of revenue under management. This statement is especially relevant for industries and segments with one player explicitly dominating the market.

Here is an example: Walmart is the only retail industry giant represented in a small town. A few local stores selling groceries are the only competitors of a Walmart's mid-sized supermarket. Generally speaking, the industry giant becomes a pricing dominant in the grocery segment as the company's prices are used by competitors as a benchmark and reference.

If there are few market players with comparable capacity and turnover, price leadership gets more complex. What it means practically is that, in such cases, a single seller can hardly be a price leader within every product group. In other words, each company is likely to be a price dominant only within one or several product groups. For example, retailer A is a price trendsetter for bakery products while retailer B sets the price benchmark for premium sweets.

Notably, the price leading model might be relevant to various types of products from new entries to Key-Value Items (KVI). That's why it is so important for the business to identify the role every SKU plays in a portfolio.

Price leadership benefits

An ability to set trends and sustain independent pricing policy are the two major benefits associated with the price leadership model. In particular, if a retailer is dominating a particular market segment, the seller can set the prices that would serve as a benchmark for customers and, eventually, the other market players.

Ultimately, it gives a freedom to set pricing trends which can define the market landscape for several months or more. Put together with the annual plan of portfolio transformation, product supplies, and regular promo campaign, the price leadership capabilities can bring a significant advantage for a seller.

Independence of pricing policy is another benefits traditionally associated with the leadership model. In practice, it means that the competition-based pricing strategy requires a seller to spend much less time and efforts as these are the other players who have to follow and react to ones practice. Yet, there are also hidden risks that are also worth being mentioned.

Price leadership drawbacks

Usually, price leaders are less conscious about the ever-changing market landscape which increases the risk of missing a particulate balance-changing market event. An example of such an event could an emergence of a new player offering a much better pricing proposal and, thus, challenging the positions of a market leader. It means that even though market leaders are less dependant on competition, they should still track the market changes and trends thoroughly.

Another disadvantage of the price leadership model stems from the fact that pricing moves of market leaders are more noticeable than the ones of those who react and, in some cases, it might have a negative impact on the customer loyalty. For example, during the periods of inflation, economic recession or turbulence, all the retailers are forced to increased prices. And as leaders' prices are serving as a benchmark for both competitors and shoppers, they are often the ones customers blame for the growing prices the first.

Three price leadership models

As we've mentioned in the very beggining, in its broad meaning, price leadership concept can be deconstructed into three specific models. The first one is the price leading model which we've already described in detail above.

Once again, it is important to point out a distinction between the price leadership concept in its broad meaning and the same-name model which implies that a particular seller is the one who sets the prices which are then used as a benchmark by the other players.

The second model is the pricing followership which is the opposite approach to price leadership, yet it is also a part of the broad leadership concept. Eventually, the third model is the synergy or combination of both price follower and price leader models. Let's take a closer look at the two latter models.

Price follower or sometimes it's better to look at the market

Price follower is a company that uses the prices set by other players as a benchmark while setting its own prices. Price followership is a reactive strategy as it becomes applicable only in case other players or at least one retailer uses the price leadership approach.

Speaking of price leadership, many retail people and industry stakeholders tend to think that being a price follower is always a worse scenario and the business should do its best to become a price trendsetter as soon as possible. However, such a statement is a rather superficial approach to pricing policy. Here is the point: being a price follower in some cases is much more beneficial and strategically advantageous for a seller than being a price leader.

Price follower could be a winning model especially in case the competition-based strategy is used by a retailer. At this point, it is necessary to note that competitive or market-driven pricing is not as simple as it might appear. Moreover, in case a retailer lacks relevant and high-quality competitive data or relies exclusively on other players' prices disregarding dozens of other pricing and non-pricing factors, the competition-based pricing could have a devastating effect.

Efffective use of a price follower model requires retailers to clearly identify the role of every SKU in a portfolio. For example, once the Best Price Guarantee (BPG) products are identified, the business has to ensure the prices for these SKUs are really best on the market. To do it, following other players' prices is inevitable. Again, being a price leader does not necessarily mean offering the best price for a product and vice versa. Moreover, in some cases, becoming a price follower is the only way to ensure that the best service is provided.

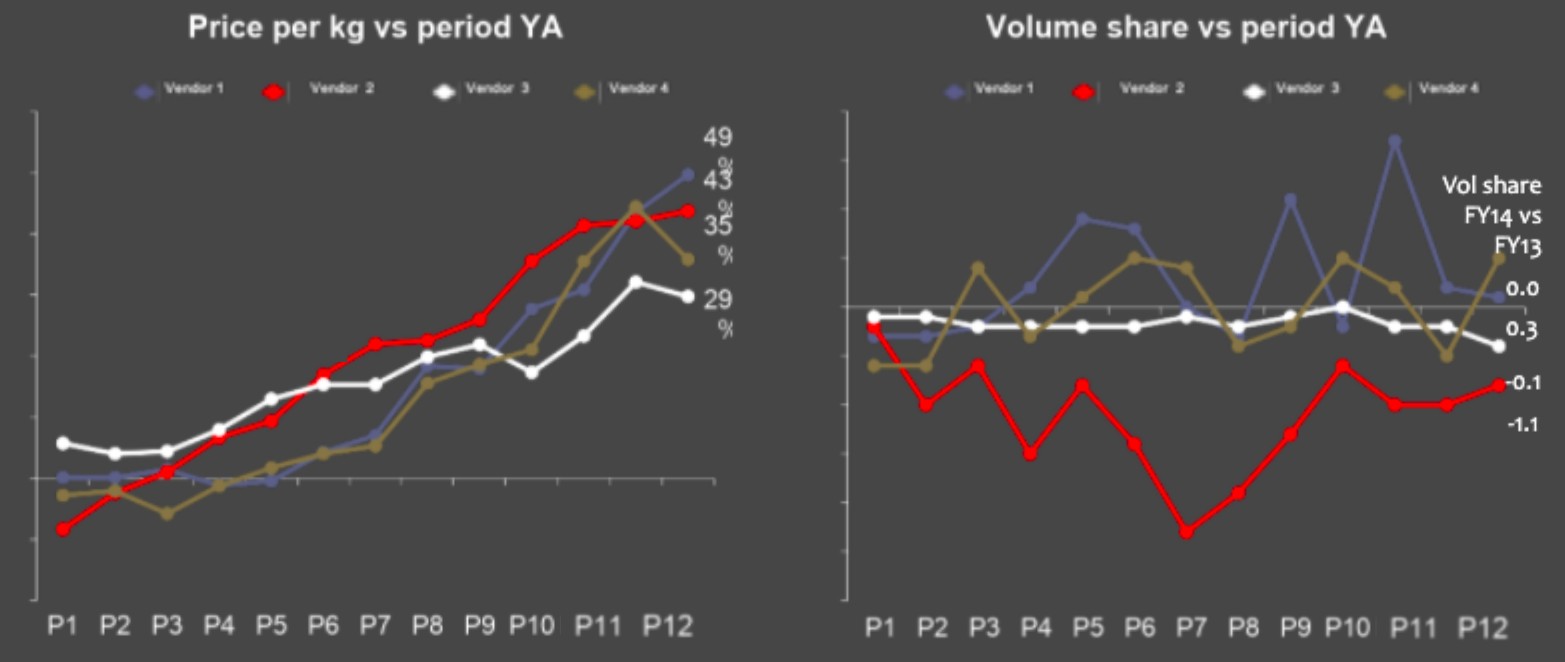

How major chocolate producers on Ukraine's market changed prices during the 2014 crisis

As the world is overcoming devastating economic consequences of the recent COVID-19 pandemic, the competition-based pricing approach becomes more and more popular across the retailers. As dozens of new market players move their sales online, the competition intensifies and customers become more sensitive towards the service quality and, of course, the price. Generally, in this case, pricing experts would recommend retailers to be the last to increase the price. And the visual above shows how this advice works in practice also highlighting the effectiveness and influence of a price follower model.

Price leading vs. price following: what about synergy?

Speaking of price leadership in retail industry, using a single model of either price leader or price follower is hardly a sustainable approach. Each retailer's portfolio contains SKUs with different roles. The latter, in turn, may change depending on the product lifecycle stage. For example, the new entry product may, eventually, become a cash generator or join the group of long-tail products.

Subsequently, the most balanced and financially healthy approach implies the combination of price leader and price follower model, i.e. one or another approach is applied depending on the product's role in the portfolio. Now, the question is which particular types of SKUs should be priced using a dominant leadership model and vice versa.

Before we'd specify the types of products towards which one or another approach works better, it is necessary to make a little disclaimer. And here it is: there are no strict rules limiting the application of a price follower or price leader model to particular types of products. What it means is that you can price some products (like, long tail items) using both models. The choice depends on the business goals, resources and data available, pricing strategy, and brand influence of a seller.

At the same time, each model is applied towards some types of products more often compared to the other. In particular, the price leader approach is commonly used in regard to new entries and an exclusive range of products. The price follower model is, in contrast, usually used towards BPG products, as well as cash and revenue generators. Once again, these are rather dominating patterns but not strict rules. Moreover, there is also a group of products towards which both approaches are applied with a similar frequency. Among others, the statement refers to the products under promo campaigns or long tail items.

How are price leaders made

It's pretty obvious that defining a role each product plays in the portfolio plays a crucial role while choosing either price leader or price follower approach. And that's where many retailers face challenges, especially in the time of increasing time transparency and tough competition. Hopefully, the algorithms behind advanced pricing software solutions can help to identify the role of each product on the shelf at every stage of its lifecycle.

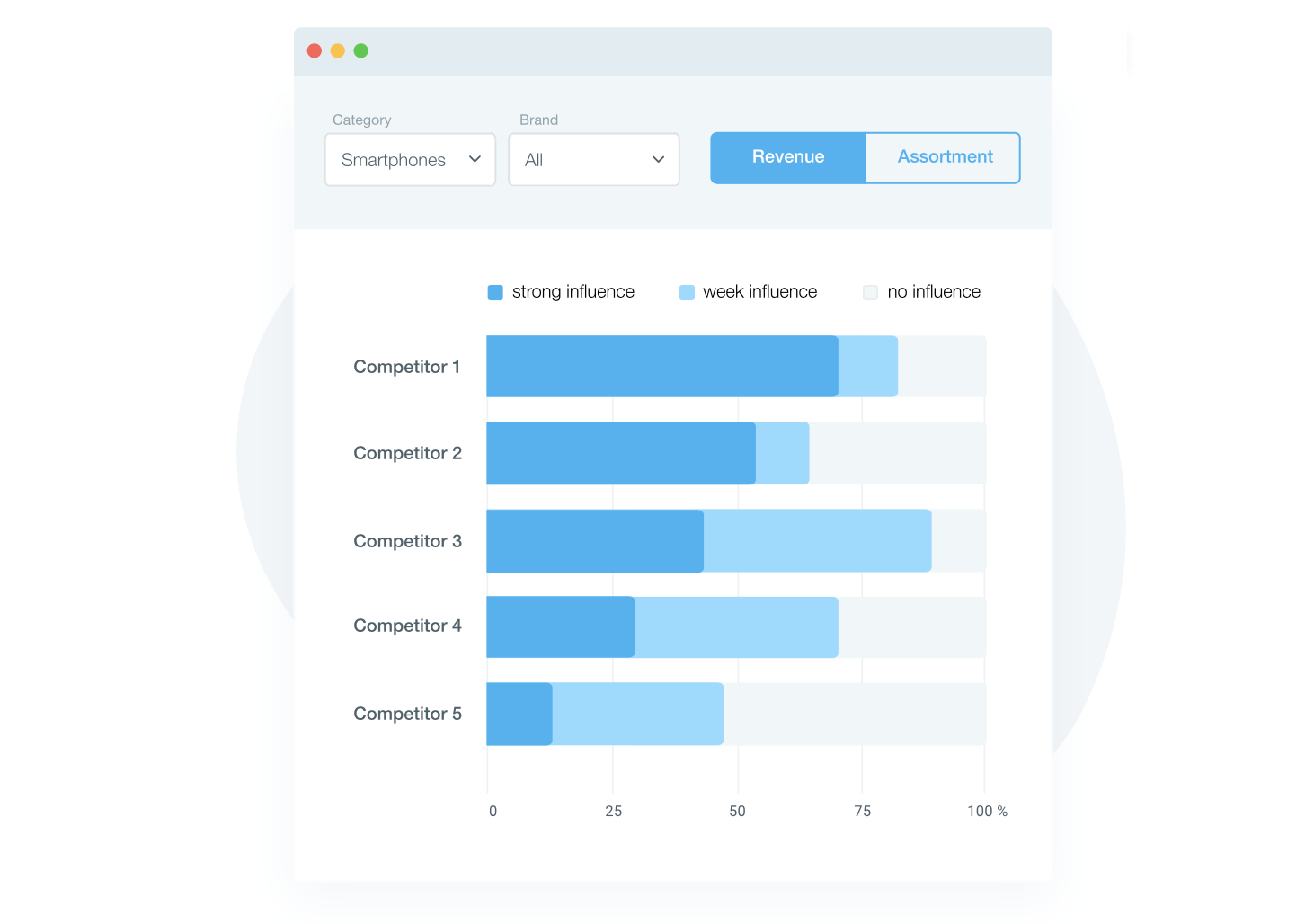

At Competera, we use a blend of top-notch technologies and sophisticated math (e.g. Graph theory, time-series based algorithm, etc) to segment products into various buckets (BPGs, long tail, KVIs Cash generators, etc) so you as a retailer can choose either price leader or price follower approach. Besides the assortment bucketing, Competera also helps retailers to identify the level of influence every competitor has on one's sales. So, you know exactly which players are really worth being followed.

Competera's 'True competitors' feature

These are only a few rough examples showing how Competera can help the business to provide customer with the top-class service and shopping experience. Leave your contacts and we'll show you more opportunities and answer all questions that might have appeared.

FAQ

Price follower is a seller who adjusts own prices to the ones set by competitors. It means that a price change by a rivaling seller is followed or reacted by corresponding actions.

Both strategies can be productive depending on the business goals and product type. For example, followership strategy works best for Best Price Guarantee (BPG) products. Understanding the role of each SKU in a portfolio is crucial to succeeding with each of the two strategies.